The Nation's Financial Condition

-

Farfromgeneva

- Posts: 23811

- Joined: Sat Feb 23, 2019 10:53 am

Re: The Nation's Financial Condition

I dont think folks are understanding waht I'm saying and living in the past. We pulled the housing lever until it's got no more room to go.

Now I love those cowboys, I love their gold

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

Re: The Nation's Financial Condition

Trying to understand......profits from Fannie and Freddie to US Treasury, yes? And the Federal .gov wrote their charter, no?Farfromgeneva wrote: ↑Mon Sep 16, 2024 1:39 pm Yeah what I'm saying is there are very dsitinct differences between USDA/FHA and FNMA/FHLMC - in their charters and otherwise. Fan and Fred were private companies with a govt backstop nothing more. One way to tell the difference? When a bank own a bond backed by a pool of FHA gtd mortgages is counts in weighted assets the regulators calculate as 0% (not an asset in the numerator which ends up in aggregate being divided by the total regulatory capital of the bank), Fan/Fred bonds are 20% risk weighted. NOT and explicit and direct gaurantee of the govt. It would be a mistake to think of Fan/Fred folks being govt workers.

TIA.

-

PizzaSnake

- Posts: 5291

- Joined: Tue Mar 05, 2019 8:36 pm

Re: The Nation's Financial Condition

Farfromgeneva wrote: ↑Mon Sep 16, 2024 1:43 pm I dont think folks are understanding waht I'm saying and living in the past. We pulled the housing lever until it's got no more room to go.

"There is nothing more difficult and more dangerous to carry through than initiating changes. One makes enemies of those who prospered under the old order, and only lukewarm support from those who would prosper under the new."

-

Farfromgeneva

- Posts: 23811

- Joined: Sat Feb 23, 2019 10:53 am

Re: The Nation's Financial Condition

They didn’t prior to their failure in 2008. That’s the point.a fan wrote: ↑Mon Sep 16, 2024 1:45 pmTrying to understand......profits from Fannie and Freddie to US Treasury, yes? And the Federal .gov wrote their charter, no?Farfromgeneva wrote: ↑Mon Sep 16, 2024 1:39 pm Yeah what I'm saying is there are very dsitinct differences between USDA/FHA and FNMA/FHLMC - in their charters and otherwise. Fan and Fred were private companies with a govt backstop nothing more. One way to tell the difference? When a bank own a bond backed by a pool of FHA gtd mortgages is counts in weighted assets the regulators calculate as 0% (not an asset in the numerator which ends up in aggregate being divided by the total regulatory capital of the bank), Fan/Fred bonds are 20% risk weighted. NOT and explicit and direct gaurantee of the govt. It would be a mistake to think of Fan/Fred folks being govt workers.

TIA.

Now I love those cowboys, I love their gold

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

-

Farfromgeneva

- Posts: 23811

- Joined: Sat Feb 23, 2019 10:53 am

Re: The Nation's Financial Condition

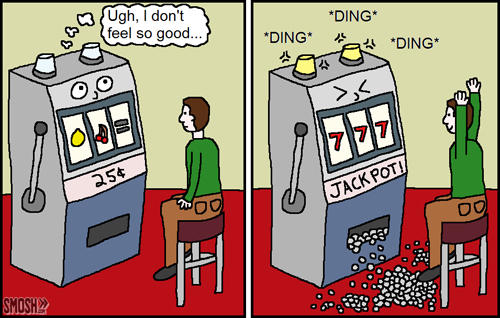

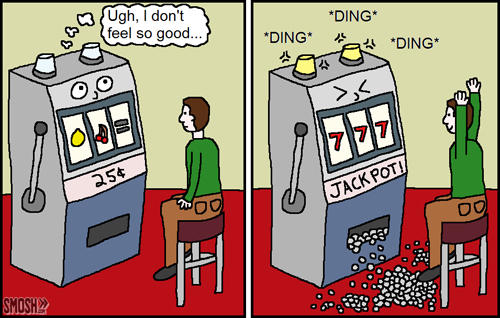

So 2024 randomness has hit FFG land very hard, would like to get some of the cling cling cling (“why you be cappin?” - https://youtu.be/XmuGBNBBu3A?si=OC4PfkkNnkj5Cf7K)PizzaSnake wrote: ↑Mon Sep 16, 2024 2:28 pmFarfromgeneva wrote: ↑Mon Sep 16, 2024 1:43 pm I dont think folks are understanding waht I'm saying and living in the past. We pulled the housing lever until it's got no more room to go.

Now I love those cowboys, I love their gold

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

Re: The Nation's Financial Condition

Ah, thanks. Appreciate your patience with me.Farfromgeneva wrote: ↑Mon Sep 16, 2024 6:45 pmThey didn’t prior to their failure in 2008. That’s the point.a fan wrote: ↑Mon Sep 16, 2024 1:45 pmTrying to understand......profits from Fannie and Freddie to US Treasury, yes? And the Federal .gov wrote their charter, no?Farfromgeneva wrote: ↑Mon Sep 16, 2024 1:39 pm Yeah what I'm saying is there are very dsitinct differences between USDA/FHA and FNMA/FHLMC - in their charters and otherwise. Fan and Fred were private companies with a govt backstop nothing more. One way to tell the difference? When a bank own a bond backed by a pool of FHA gtd mortgages is counts in weighted assets the regulators calculate as 0% (not an asset in the numerator which ends up in aggregate being divided by the total regulatory capital of the bank), Fan/Fred bonds are 20% risk weighted. NOT and explicit and direct gaurantee of the govt. It would be a mistake to think of Fan/Fred folks being govt workers.

TIA.

Re: The Nation's Financial Condition

Was indeed. Thx for the article. The wealth disparity created will last generations with adverse effects in healthcare, life expectancy, education.

I have relatives in Buckhead but not of what is going on

I have relatives in Buckhead but not of what is going on

- youthathletics

- Posts: 15790

- Joined: Mon Jul 30, 2018 7:36 pm

Re: The Nation's Financial Condition

A fraudulent intent, however carefully concealed at the outset, will generally, in the end, betray itself.

~Livy

“There are two ways to be fooled. One is to believe what isn’t true; the other is to refuse to believe what is true.” -Soren Kierkegaard

~Livy

“There are two ways to be fooled. One is to believe what isn’t true; the other is to refuse to believe what is true.” -Soren Kierkegaard

-

Farfromgeneva

- Posts: 23811

- Joined: Sat Feb 23, 2019 10:53 am

Re: The Nation's Financial Condition

Apologies I honestly thought you and most folks knew they had public stock (common equity) and have incorporated in like the 60s. It was crazy these arrogant Fannie/freddie employees aitring there with this backdrop so they can do anything and they get to act like their helping Americansa fan wrote: ↑Mon Sep 16, 2024 7:02 pmAh, thanks. Appreciate your patience with me.Farfromgeneva wrote: ↑Mon Sep 16, 2024 6:45 pmThey didn’t prior to their failure in 2008. That’s the point.a fan wrote: ↑Mon Sep 16, 2024 1:45 pmTrying to understand......profits from Fannie and Freddie to US Treasury, yes? And the Federal .gov wrote their charter, no?Farfromgeneva wrote: ↑Mon Sep 16, 2024 1:39 pm Yeah what I'm saying is there are very dsitinct differences between USDA/FHA and FNMA/FHLMC - in their charters and otherwise. Fan and Fred were private companies with a govt backstop nothing more. One way to tell the difference? When a bank own a bond backed by a pool of FHA gtd mortgages is counts in weighted assets the regulators calculate as 0% (not an asset in the numerator which ends up in aggregate being divided by the total regulatory capital of the bank), Fan/Fred bonds are 20% risk weighted. NOT and explicit and direct gaurantee of the govt. It would be a mistake to think of Fan/Fred folks being govt workers.

TIA.

So yeah the govt stepped in with the mass losses and insolvency and said now it’s officially our “nut” and we’re gonna sweep all cash flows directly now. Going on 15yrs now. I never understood the public stock but you want to get mad at banks and fdic deposit insurance for banks then you should be dipshit about the folks at Fan and Fred for like 25yrs

Now I love those cowboys, I love their gold

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

-

Farfromgeneva

- Posts: 23811

- Joined: Sat Feb 23, 2019 10:53 am

Re: The Nation's Financial Condition

Ask your relatives if any of the men were ever in the diplomats. A club I was in first few years after moving from nyc to Atl. Meetings and home base was capitol city country club in Buckhead.

While I’m suggesting the mass public needs another path to wealth accumulation going forward than real estate (personal residence as investment vehicle indiriectly) note the wealthiest folks and what they’ve invested in last few years and how most folks are putting all their. Life’s on subscriptions and not owning much of anything.

Step 1: find curvelinear comp model profession (not a trade gig)

Step 2: Figure out a way to make you assets earn all the time. Lofeninsurnefe peoim finance loan, etc

Now I love those cowboys, I love their gold

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

-

Farfromgeneva

- Posts: 23811

- Joined: Sat Feb 23, 2019 10:53 am

Re: The Nation's Financial Condition

B to the Syouthathletics wrote: ↑Mon Sep 16, 2024 7:35 pm Tax avoidance salary, Tax loop hole, or BS?

https://www.instagram.com/reel/C9qSl6yy ... E0bWFpaHR3

Now I love those cowboys, I love their gold

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

Re: The Nation's Financial Condition

No, I learned that part during the crash. What I didn't know, or perhaps remember (thank you), was that they changed this practice after 08.Farfromgeneva wrote: ↑Mon Sep 16, 2024 8:30 pmApologies I honestly thought you and most folks knew they had public stock (common equity) and have incorporated in like the 60s. It was crazy these arrogant Fannie/freddie employees aitring there with this backdrop so they can do anything and they get to act like their helping Americansa fan wrote: ↑Mon Sep 16, 2024 7:02 pmAh, thanks. Appreciate your patience with me.Farfromgeneva wrote: ↑Mon Sep 16, 2024 6:45 pmThey didn’t prior to their failure in 2008. That’s the point.a fan wrote: ↑Mon Sep 16, 2024 1:45 pmTrying to understand......profits from Fannie and Freddie to US Treasury, yes? And the Federal .gov wrote their charter, no?Farfromgeneva wrote: ↑Mon Sep 16, 2024 1:39 pm Yeah what I'm saying is there are very dsitinct differences between USDA/FHA and FNMA/FHLMC - in their charters and otherwise. Fan and Fred were private companies with a govt backstop nothing more. One way to tell the difference? When a bank own a bond backed by a pool of FHA gtd mortgages is counts in weighted assets the regulators calculate as 0% (not an asset in the numerator which ends up in aggregate being divided by the total regulatory capital of the bank), Fan/Fred bonds are 20% risk weighted. NOT and explicit and direct gaurantee of the govt. It would be a mistake to think of Fan/Fred folks being govt workers.

TIA.

I most certainly am! Appreciate the high level help....truly.Farfromgeneva wrote: ↑Mon Sep 16, 2024 8:30 pm

So yeah the govt stepped in with the mass losses and insolvency and said now it’s officially our “nut” and we’re gonna sweep all cash flows directly now. Going on 15yrs now. I never understood the public stock but you want to get mad at banks and fdic deposit insurance for banks then you should be dipshit about the folks at Fan and Fred for like 25yrs

-

PizzaSnake

- Posts: 5291

- Joined: Tue Mar 05, 2019 8:36 pm

Re: The Nation's Financial Condition

Monetary policy limbo — how low will it go?

https://www.nytimes.com/2024/09/18/busi ... e-cut.html

“Fed officials kicked off rate cuts with a half-point reduction, confident that inflation is cooling and eager to keep the job market strong.”

https://www.nytimes.com/2024/09/18/busi ... e-cut.html

“Fed officials kicked off rate cuts with a half-point reduction, confident that inflation is cooling and eager to keep the job market strong.”

"There is nothing more difficult and more dangerous to carry through than initiating changes. One makes enemies of those who prospered under the old order, and only lukewarm support from those who would prosper under the new."

-

Farfromgeneva

- Posts: 23811

- Joined: Sat Feb 23, 2019 10:53 am

Re: The Nation's Financial Condition

Ten Ye UST should “normalize” around +100bps to Fed funds when we get back to a positively sloping curve. That would suggest 2.5-2.75% today based on a 3:6…% 10yr yield at the moment (keep in mind mortgages and longer duration secured credits often run off the 1yr UST or swap basis equivalent so an important point within the curv). I think we land more like 3.25-4% and the ten year when soon positively will bump around around +50+75bps which gets iuo a little higher on the ten year and not as low on Fed funds- like 3.25%-4.00% FF-10yrPizzaSnake wrote: ↑Wed Sep 18, 2024 6:54 pm Monetary policy limbo — how low will it go?

https://www.nytimes.com/2024/09/18/busi ... e-cut.html

“Fed officials kicked off rate cuts with a half-point reduction, confident that inflation is cooling and eager to keep the job market strong.”

What’s critical is that 2.5% is still manfully higher, than is was for more or less fifteen years of zirp (zero interest rate policy). It’s an extra $2k a month on a $1mm small business loan for many.

Now I love those cowboys, I love their gold

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah