And instead of being paid, you can just tell prospective clients that you defended Trump....that has more value than cash.seacoaster wrote: ↑Sun Jan 31, 2021 8:06 amI think the basic terms are: wear a tie; appear on television like a flak (Miller, Hogan Gidley, etc.); advance the Big Lie in the Senate Chamber and on TV; flatter the former President a lot. Deal?njbill wrote: ↑Sat Jan 30, 2021 10:12 pmDo I have to wear a tie?seacoaster wrote: ↑Sat Jan 30, 2021 9:24 pmExactly. “That was fun, but you can’t send it.”

CNN reporting two South Carolina lawyer have left Trump’s impeachment defense team. Bill, there is still time!!

Orange Duce

-

Typical Lax Dad

- Posts: 32865

- Joined: Mon Jul 30, 2018 12:10 pm

Re: Orange Duce

“You lucky I ain’t read wretched yet!”

- 3rdPersonPlural

- Posts: 569

- Joined: Sat Aug 18, 2018 11:09 pm

- Location: Rust Belt

- Contact:

Re: Orange Duce

OOOOH! NJ Bill, I'm 100% behind this!Typical Lax Dad wrote: ↑Sun Jan 31, 2021 1:25 pmAnd instead of being paid, you can just tell prospective clients that you defended Trump....that has more value than cash.seacoaster wrote: ↑Sun Jan 31, 2021 8:06 amI think the basic terms are: wear a tie; appear on television like a flak (Miller, Hogan Gidley, etc.); advance the Big Lie in the Senate Chamber and on TV; flatter the former President a lot. Deal?njbill wrote: ↑Sat Jan 30, 2021 10:12 pmDo I have to wear a tie?seacoaster wrote: ↑Sat Jan 30, 2021 9:24 pmExactly. “That was fun, but you can’t send it.”

CNN reporting two South Carolina lawyer have left Trump’s impeachment defense team. Bill, there is still time!!

Heck, I'll even take just 5% of the fee. But you better get the money up front. 45 is known to stiff people who are vendors......

-

Typical Lax Dad

- Posts: 32865

- Joined: Mon Jul 30, 2018 12:10 pm

Re: Orange Duce

I know a contractor in DC whose attorney told him not to take a carpentry contract for Trump hotel. Guy passed and later learned folks got stiffed.3rdPersonPlural wrote: ↑Sun Jan 31, 2021 4:36 pmOOOOH! NJ Bill, I'm 100% behind this!Typical Lax Dad wrote: ↑Sun Jan 31, 2021 1:25 pmAnd instead of being paid, you can just tell prospective clients that you defended Trump....that has more value than cash.seacoaster wrote: ↑Sun Jan 31, 2021 8:06 amI think the basic terms are: wear a tie; appear on television like a flak (Miller, Hogan Gidley, etc.); advance the Big Lie in the Senate Chamber and on TV; flatter the former President a lot. Deal?njbill wrote: ↑Sat Jan 30, 2021 10:12 pmDo I have to wear a tie?seacoaster wrote: ↑Sat Jan 30, 2021 9:24 pmExactly. “That was fun, but you can’t send it.”

CNN reporting two South Carolina lawyer have left Trump’s impeachment defense team. Bill, there is still time!!

Heck, I'll even take just 5% of the fee. But you better get the money up front. 45 is known to stiff people who are vendors......

“You lucky I ain’t read wretched yet!”

- MDlaxfan76

- Posts: 26389

- Joined: Wed Aug 01, 2018 5:40 pm

Re: Orange Duce

Sweet bunch these folks:

https://www.cnn.com/2021/01/31/us/capit ... index.html

whack jobs with guns...

https://www.cnn.com/2021/01/31/us/capit ... index.html

whack jobs with guns...

Re: Orange Duce

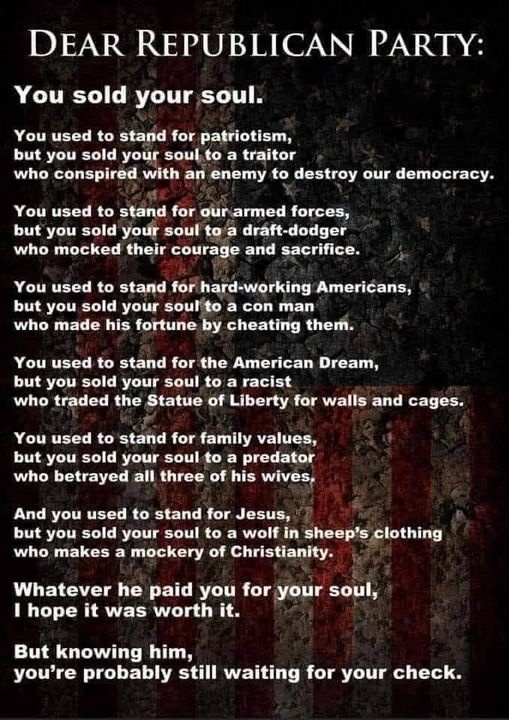

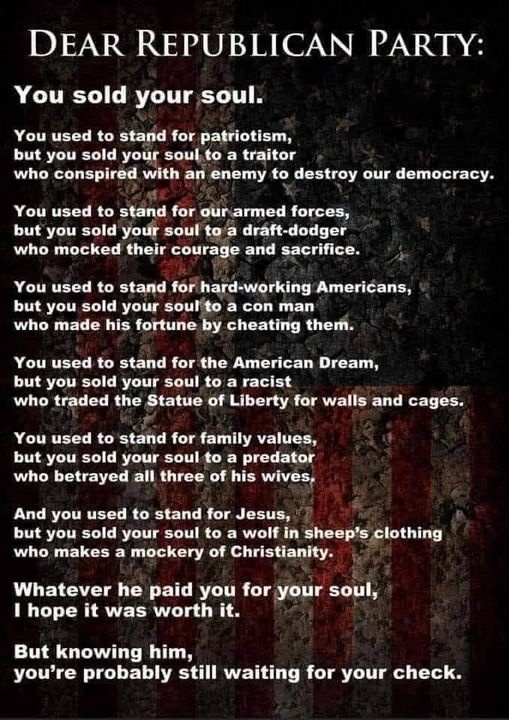

rePUKEblicans today:

https://uploads.disquscdn.com/images/09 ... e21e2a.jpg

The world's biggest sellout artists.

https://uploads.disquscdn.com/images/09 ... e21e2a.jpg

The world's biggest sellout artists.

It has been proven a hundred times that the surest way to the heart of any man, black or white, honest or dishonest, is through justice and fairness.

Charles Francis "Socker" Coe, Esq

Charles Francis "Socker" Coe, Esq

Re: Orange Duce

repukeblicans:

It has been proven a hundred times that the surest way to the heart of any man, black or white, honest or dishonest, is through justice and fairness.

Charles Francis "Socker" Coe, Esq

Charles Francis "Socker" Coe, Esq

Re: Orange Douche

Trump Raised $76 Million — Then Spent Nothing On Vote Challenges Or Georgia

Trump’s bait-and-switch ads cited the need to contest his election loss and for the GOP to hold the Senate as he sought funds for his “leadership” PAC.

https://www.huffpost.com/entry/trump-sl ... e2f5c232bb

Then-President Donald Trump raised $76 million for a political slush fund by citing the need to challenge his Nov. 3 reelection loss and for Republicans to win two Senate runoffs in Georgia, but through the end of 2020 he did not spend a dime of it on either.

“He put nothing back. He didn’t care,” said one top Republican familiar with the fundraising operation who spoke on condition of anonymity, adding that Trump intends to use the money to pay his personal, non-election-related, legal bills. “He put all this money in the bank for his own legal fights. He never cared about Georgia’s races.”

Trump faces a series of legal problems, both civil and criminal, for issues ranging from sexual misconduct allegations to potential tax fraud inquiries. And his second Senate impeachment trial starts next week; this time he is charged with inciting the violent mob that attacked the U.S. Capitol on Jan. 6.

Jason Miller, one of a handful of former campaign and White House aides who continue to work for Trump in his post-presidency, did not respond to HuffPost queries.

Many Republicans say that, far from helping his party win the Jan. 5 Georgia races, Trump’s repeated lies about the election having been stolen from him ― particularly in the Peach State, where he narrowly lost to Democrat Joe Biden ― depressed turnout among GOP voters and cost them both seats and control of the Senate.

Trump’s “Save America” leadership committee, which he can use for just about any purpose he wants, including paying himself a salary, reported ending the year with $31.2 million in the bank. And it’s entitled to another $45 million sitting in the account of a joint fundraising committee with the Republican National Committee.

That joint operation, the Trump Make America Great Again Committee, sent out hundreds of fundraising emails and texts on Save America’s behalf starting from Nov. 11 right through Jan. 6, just minutes before the mob of Trump supporters attacked the Capitol after being instructed by him to stop Congress from officially certifying Biden’s victory. Five people died during the riot, including one police officer killed by the mob, and 140 were injured.

“TODAY will be a historic day in our Nation’s history. Congress will either certify, or object to, the Election results,” a 1:23 p.m. email on Jan. 6 read. “Every single Patriot from across the Country must step up RIGHT NOW if we’re going to successfully DEFEND the integrity of this Election. President Trump is calling on YOU to bolster our Official Defend America Fund.”

In reality, though, the only money Save America spent through the end of December were payments totaling $343,000 to WinRed, a GOP campaign payment processing company, according to a HuffPost review of year-end Federal Election Commission reports filed late Sunday.

Nor was any of Save America’s money spent to help the Georgia Republican senators, despite 39 emails and 9 text messages that specifically cited those Senate races.

“Dem Elites are funneling MILLIONS into Georgia to RIP AWAY the Senate. Pres Trump needs YOU to step up,” read a text sent on Dec. 1.

A text sent on the day of the runoff cited potential voting glitches as a reason to donate money. “If it’s true that voting machines briefly stopped working in Georgia today, then we must remain vigilant! Don’t wait ― ACT NOW,” it read, without mentioning that the money went to Save America, and had nothing to do with Georgia.

So-called “leadership PACs” are loosely regulated committees often used by politicians to build support among their peers by donating to their campaigns. However, unlike formal campaign committees, those controlling leadership PACs can use the money to pick up their own personal expenses or even pay themselves a salary.

One of the few things Trump cannot use Save America for, in fact, is to pay campaign expenses for another presidential run, should he choose to try to reclaim the White House in 2024.

tRUMP enriches himself while delusional right wingers put money into his pockets.

Trump’s bait-and-switch ads cited the need to contest his election loss and for the GOP to hold the Senate as he sought funds for his “leadership” PAC.

https://www.huffpost.com/entry/trump-sl ... e2f5c232bb

Then-President Donald Trump raised $76 million for a political slush fund by citing the need to challenge his Nov. 3 reelection loss and for Republicans to win two Senate runoffs in Georgia, but through the end of 2020 he did not spend a dime of it on either.

“He put nothing back. He didn’t care,” said one top Republican familiar with the fundraising operation who spoke on condition of anonymity, adding that Trump intends to use the money to pay his personal, non-election-related, legal bills. “He put all this money in the bank for his own legal fights. He never cared about Georgia’s races.”

Trump faces a series of legal problems, both civil and criminal, for issues ranging from sexual misconduct allegations to potential tax fraud inquiries. And his second Senate impeachment trial starts next week; this time he is charged with inciting the violent mob that attacked the U.S. Capitol on Jan. 6.

Jason Miller, one of a handful of former campaign and White House aides who continue to work for Trump in his post-presidency, did not respond to HuffPost queries.

Many Republicans say that, far from helping his party win the Jan. 5 Georgia races, Trump’s repeated lies about the election having been stolen from him ― particularly in the Peach State, where he narrowly lost to Democrat Joe Biden ― depressed turnout among GOP voters and cost them both seats and control of the Senate.

Trump’s “Save America” leadership committee, which he can use for just about any purpose he wants, including paying himself a salary, reported ending the year with $31.2 million in the bank. And it’s entitled to another $45 million sitting in the account of a joint fundraising committee with the Republican National Committee.

That joint operation, the Trump Make America Great Again Committee, sent out hundreds of fundraising emails and texts on Save America’s behalf starting from Nov. 11 right through Jan. 6, just minutes before the mob of Trump supporters attacked the Capitol after being instructed by him to stop Congress from officially certifying Biden’s victory. Five people died during the riot, including one police officer killed by the mob, and 140 were injured.

“TODAY will be a historic day in our Nation’s history. Congress will either certify, or object to, the Election results,” a 1:23 p.m. email on Jan. 6 read. “Every single Patriot from across the Country must step up RIGHT NOW if we’re going to successfully DEFEND the integrity of this Election. President Trump is calling on YOU to bolster our Official Defend America Fund.”

In reality, though, the only money Save America spent through the end of December were payments totaling $343,000 to WinRed, a GOP campaign payment processing company, according to a HuffPost review of year-end Federal Election Commission reports filed late Sunday.

Nor was any of Save America’s money spent to help the Georgia Republican senators, despite 39 emails and 9 text messages that specifically cited those Senate races.

“Dem Elites are funneling MILLIONS into Georgia to RIP AWAY the Senate. Pres Trump needs YOU to step up,” read a text sent on Dec. 1.

A text sent on the day of the runoff cited potential voting glitches as a reason to donate money. “If it’s true that voting machines briefly stopped working in Georgia today, then we must remain vigilant! Don’t wait ― ACT NOW,” it read, without mentioning that the money went to Save America, and had nothing to do with Georgia.

So-called “leadership PACs” are loosely regulated committees often used by politicians to build support among their peers by donating to their campaigns. However, unlike formal campaign committees, those controlling leadership PACs can use the money to pick up their own personal expenses or even pay themselves a salary.

One of the few things Trump cannot use Save America for, in fact, is to pay campaign expenses for another presidential run, should he choose to try to reclaim the White House in 2024.

tRUMP enriches himself while delusional right wingers put money into his pockets.

It has been proven a hundred times that the surest way to the heart of any man, black or white, honest or dishonest, is through justice and fairness.

Charles Francis "Socker" Coe, Esq

Charles Francis "Socker" Coe, Esq

-

Typical Lax Dad

- Posts: 32865

- Joined: Mon Jul 30, 2018 12:10 pm

-

Farfromgeneva

- Posts: 23267

- Joined: Sat Feb 23, 2019 10:53 am

Re: Orange Duce

It’s going to be interesting if he has to get money from sharp elbowed financiers like Ares, Apollo, Canyon, Oaktree, etc. If he has to get dough from that crowd he’s going to get his balls tied up on any deal. SOFR + 600-1,000bps plus a couple of points in and maybe an exit fee plus full recourse and probably some other consideration. And that cohort doesn’t agree around with extensions and modifications. If you don’t pay they take they’re collateral and jam you up in court super fast.

Now I love those cowboys, I love their gold

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

Re: Orange Duce

OD resigned from the Screen Actors Guild today in a hissy fit when he discovered they were going to expel him for his role in the insurrection on January 6. How appropriate for the boss of The Apprentice to get canned himself!

-

Farfromgeneva

- Posts: 23267

- Joined: Sat Feb 23, 2019 10:53 am

Re: Orange Duce

Can they make a fake gold encrusted spider hole?

Now I love those cowboys, I love their gold

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

-

Typical Lax Dad

- Posts: 32865

- Joined: Mon Jul 30, 2018 12:10 pm

Re: Orange Duce

I just closed an amendment for a deal with a uni-tranche lender. A modest ask given COVID.... they took the sponsor to the cleaners.Farfromgeneva wrote: ↑Thu Feb 04, 2021 11:38 am It’s going to be interesting if he has to get money from sharp elbowed financiers like Ares, Apollo, Canyon, Oaktree, etc. If he has to get dough from that crowd he’s going to get his balls tied up on any deal. SOFR + 600-1,000bps plus a couple of points in and maybe an exit fee plus full recourse and probably some other consideration. And that cohort doesn’t agree around with extensions and modifications. If you don’t pay they take they’re collateral and jam you up in court super fast.

“You lucky I ain’t read wretched yet!”

-

Farfromgeneva

- Posts: 23267

- Joined: Sat Feb 23, 2019 10:53 am

Re: Orange Duce

I'm sure. I would guess they probably missed on projections, especially on the revenue (synergy? if a deal financing) side as well as overall, even before Covid. Gives the lenders a "reset" opportunity now that the deal is controlled and not being competitively bid on in the primary financing market. They always show charts of delevering from 6-10x Debt/EBITDA to 3x in five years, but get only 20% of the way there and, markets willing, come back for another dividend recap loan in year 3.

It's not about the technical merits of holding a borrower/sponsor accountable or anything like that, it's all about who has the leverage. And DJT has zero leverage today or for the forseeable future. It's like lending to a dying Michael Jackson on Neverland Ranch at 15% on a low loan to value while he's fighting pedohilia accusations/charges lednign to Trump now. He was considered a bad borrower (a real term) in the 1990s and lost many banks back then already, the few remaining gone means his assets are up for grabs pretty much and he's going to have to execute on the operations of those properties (hotels and golf courses which are much more operating businesses than owning apartments or office bldgs.) and we all know execution is not a strength of this clownshoe.

It's not about the technical merits of holding a borrower/sponsor accountable or anything like that, it's all about who has the leverage. And DJT has zero leverage today or for the forseeable future. It's like lending to a dying Michael Jackson on Neverland Ranch at 15% on a low loan to value while he's fighting pedohilia accusations/charges lednign to Trump now. He was considered a bad borrower (a real term) in the 1990s and lost many banks back then already, the few remaining gone means his assets are up for grabs pretty much and he's going to have to execute on the operations of those properties (hotels and golf courses which are much more operating businesses than owning apartments or office bldgs.) and we all know execution is not a strength of this clownshoe.

Now I love those cowboys, I love their gold

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

-

Typical Lax Dad

- Posts: 32865

- Joined: Mon Jul 30, 2018 12:10 pm

Re: Orange Duce

Some issue came up not caught in QoE and then COVID hit. Not that bad considering 2020. Didn’t meet step downs but basically treading water since close.....we like deals that can fully amortize in 7 years even if there is a balloon. Depending on industry we will be more or less aggressive but that 7 year horizon gives us some latitude.....Uni-tranche guys stuck it to them. Other portfolio companies had lenders work with them....mot these guys. We have an ABL structure on top of their deal. Non issue for us, really.Farfromgeneva wrote: ↑Thu Feb 04, 2021 3:33 pm I'm sure. I would guess they probably missed on projections, especially on the revenue (synergy? if a deal financing) side as well as overall, even before Covid. Gives the lenders a "reset" opportunity now that the deal is controlled and not being competitively bid on in the primary financing market. They always show charts of delevering from 6-10x Debt/EBITDA to 3x in five years, but get only 20% of the way there and, markets willing, come back for another dividend recap loan in year 3.

It's not about the technical merits of holding a borrower/sponsor accountable or anything like that, it's all about who has the leverage. And DJT has zero leverage today or for the forseeable future. It's like lending to a dying Michael Jackson on Neverland Ranch at 15% on a low loan to value while he's fighting pedohilia accusations/charges lednign to Trump now. He was considered a bad borrower (a real term) in the 1990s and lost many banks back then already, the few remaining gone means his assets are up for grabs pretty much and he's going to have to execute on the operations of those properties (hotels and golf courses which are much more operating businesses than owning apartments or office bldgs.) and we all know execution is not a strength of this clownshoe.

“You lucky I ain’t read wretched yet!”

-

Farfromgeneva

- Posts: 23267

- Joined: Sat Feb 23, 2019 10:53 am

Re: Orange Duce

At this point treading water is good. The amortization is a good thing but must involve tangible asset heavy, true equity position businesses I would think, with stale but reliable cash flows (vs. typical middle market PE roll up a bunch of smaller businesses and get a bigger multiple selling to another strategic or financial buyer), no? Harder with more contemporary businesses unless some serious growth occurs in which case it's not normal PE. My father in laws company was owned by JH Whitney up in your hood for a few years, end of millenia until around 04-05. Large regional commercial sub electrical engineering firm with at the time maybe 150-200MM in rev. Was acquired by a Candian public co (braddick or braddish?) who was rolling up subs to become a global player like Fluor or Bechtel and sold to them at like 8-9x EBITDA (when fed funds was like 6%!) and the public co went BK. Whitney had been negotiating a private bailout which, in classic PE fashion, they bailed at the witching hour and then scooped up a handful of subsidiaries in the auction process based on superior info at like 2.5x EBTIDA. They did very little to firm which grew in a steady eddy fashion and when the fund was near the end of it's life they didn't have a natural buyer so management bought the company back at 4.5x EBITDA which had grown to about $250MM at that point (now around $500MM). They even financed inidivudal buyers at their pref rate of 7%, so my father in law went from accumulating 3% ish pre sale through just buying in since college (he graduated in 1982 from Ga Tech) to around 7% now and paid off his nut with Whitney within 2yrs, so now he clips a healthy salary and bonus as a employee and a dividend check that becomes a tax problem each spring. Whitney made a killing and didn't have to over lever or do any financial engineering, just clipped a north of 20% cash flow yield for 6-7 years easy peasy.

Bank lenders are very different than non bank lenders as you know. CLO asset managers are usually pretty easy too, just want to keep the stream of payments coming. It's the private credit, which has exploded last five to ten years, where the world is different. Bank ABL workout guys think they're loans are always worth par no matter what so they play along.

My buddy who was co-head of spec fin ibanking at STRH (Suntrust's IBank) until 2016-2017 and is close with the BDC universe as well as equipment finance, alternative credit managers, etc in that space thinks the Apollo's are going to completely disintermediate the banks on lending & commercial credit all the way up to the top 100 or so companies. I think he's crazy, the gov't won't allow funds to shut companies down as creditors that quicky and harm employees so I think they'll end up heavily regulated if that starts to occur. It's natural that the largest equity players are moving into credit since it represents a far larger universe to build (and charge for) AUM, but I don't think they really know what they're getting into come a true turn in the credit cycle. Reality is loans are still bundled to other services and credit is practically free these days, so I don't know how you can make a ROE off basic lending these days.

BTW, QOEs are almost always BS. Just CYA for the file and potential lawsuits from investors down the road. As massaged as MAI (Made as instructed) appraisals are in the CRE business.

Bank lenders are very different than non bank lenders as you know. CLO asset managers are usually pretty easy too, just want to keep the stream of payments coming. It's the private credit, which has exploded last five to ten years, where the world is different. Bank ABL workout guys think they're loans are always worth par no matter what so they play along.

My buddy who was co-head of spec fin ibanking at STRH (Suntrust's IBank) until 2016-2017 and is close with the BDC universe as well as equipment finance, alternative credit managers, etc in that space thinks the Apollo's are going to completely disintermediate the banks on lending & commercial credit all the way up to the top 100 or so companies. I think he's crazy, the gov't won't allow funds to shut companies down as creditors that quicky and harm employees so I think they'll end up heavily regulated if that starts to occur. It's natural that the largest equity players are moving into credit since it represents a far larger universe to build (and charge for) AUM, but I don't think they really know what they're getting into come a true turn in the credit cycle. Reality is loans are still bundled to other services and credit is practically free these days, so I don't know how you can make a ROE off basic lending these days.

BTW, QOEs are almost always BS. Just CYA for the file and potential lawsuits from investors down the road. As massaged as MAI (Made as instructed) appraisals are in the CRE business.

Now I love those cowboys, I love their gold

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

-

Typical Lax Dad

- Posts: 32865

- Joined: Mon Jul 30, 2018 12:10 pm

Re: Orange Duce

Yep......we passed on the acquisition deal and just did the ABL... I am curious to see where Donald ends up..... he will be paying a liquidity premium. Didn’t Ladder Capital sell out?Farfromgeneva wrote: ↑Thu Feb 04, 2021 4:25 pm At this point treading water is good. The amortization is a good thing but must involve tangible asset heavy, true equity position businesses I would think, with stale but reliable cash flows (vs. typical middle market PE roll up a bunch of smaller businesses and get a bigger multiple selling to another strategic or financial buyer), no? Harder with more contemporary businesses unless some serious growth occurs in which case it's not normal PE. My father in laws company was owned by JH Whitney up in your hood for a few years, end of millenia until around 04-05. Large regional commercial sub electrical engineering firm with at the time maybe 150-200MM in rev. Was acquired by a Candian public co (braddick or braddish?) who was rolling up subs to become a global player like Fluor or Bechtel and sold to them at like 8-9x EBITDA (when fed funds was like 6%!) and the public co went BK. Whitney had been negotiating a private bailout which, in classic PE fashion, they bailed at the witching hour and then scooped up a handful of subsidiaries in the auction process based on superior info at like 2.5x EBTIDA. They did very little to firm which grew in a steady eddy fashion and when the fund was near the end of it's life they didn't have a natural buyer so management bought the company back at 4.5x EBITDA which had grown to about $250MM at that point (now around $500MM). They even financed inidivudal buyers at their pref rate of 7%, so my father in law went from accumulating 3% ish pre sale through just buying in since college (he graduated in 1982 from Ga Tech) to around 7% now and paid off his nut with Whitney within 2yrs, so now he clips a healthy salary and bonus as a employee and a dividend check that becomes a tax problem each spring. Whitney made a killing and didn't have to over lever or do any financial engineering, just clipped a north of 20% cash flow yield for 6-7 years easy peasy.

Bank lenders are very different than non bank lenders as you know. CLO asset managers are usually pretty easy too, just want to keep the stream of payments coming. It's the private credit, which has exploded last five to ten years, where the world is different. Bank ABL workout guys think they're loans are always worth par no matter what so they play along.

My buddy who was co-head of spec fin ibanking at STRH (Suntrust's IBank) until 2016-2017 and is close with the BDC universe as well as equipment finance, alternative credit managers, etc in that space thinks the Apollo's are going to completely disintermediate the banks on lending & commercial credit all the way up to the top 100 or so companies. I think he's crazy, the gov't won't allow funds to shut companies down as creditors that quicky and harm employees so I think they'll end up heavily regulated if that starts to occur. It's natural that the largest equity players are moving into credit since it represents a far larger universe to build (and charge for) AUM, but I don't think they really know what they're getting into come a true turn in the credit cycle. Reality is loans are still bundled to other services and credit is practically free these days, so I don't know how you can make a ROE off basic lending these days.

BTW, QOEs are almost always BS. Just CYA for the file and potential lawsuits from investors down the road. As massaged as MAI (Made as instructed) appraisals are in the CRE business.

“You lucky I ain’t read wretched yet!”

-

Farfromgeneva

- Posts: 23267

- Joined: Sat Feb 23, 2019 10:53 am

Re: Orange Duce

But you're non bank so I assume, depending on size, you were still L (or SOFR) + 450-700bps even on a decent deal? Vs the L + 200 you can get from a Citizens Bank or PNC on an ABL deal in the middle market.

Ladder is still independent I believe, but they aren't in a position to fund $250MM+ deals, or really even lead them. Mostly doing CMBS lending (originate and distribute) which wouldn't work for Trump's assets, these days. I know they had an issue when Greta Guggenheim left, Brian Harris was a strong trader, but she managed the business really, really well, but she left a few years ago.

Trump needs a balance sheet lender for these unique asset hotels and golf courses. Cash flows are too lumpy to pool up. And that means he's going to have to deleverage personally and start living a little more modestly than he has for a long time, especially with his TV money having basically dried up earlier in the prior decade (information has shown by 2014-2015 his income was plummeting while his expenses where stable and rising). Can't keep rolling over loans with this crowd. The golf courses which were ego plays are going to be his ultimate downfall.

Ladder is still independent I believe, but they aren't in a position to fund $250MM+ deals, or really even lead them. Mostly doing CMBS lending (originate and distribute) which wouldn't work for Trump's assets, these days. I know they had an issue when Greta Guggenheim left, Brian Harris was a strong trader, but she managed the business really, really well, but she left a few years ago.

Trump needs a balance sheet lender for these unique asset hotels and golf courses. Cash flows are too lumpy to pool up. And that means he's going to have to deleverage personally and start living a little more modestly than he has for a long time, especially with his TV money having basically dried up earlier in the prior decade (information has shown by 2014-2015 his income was plummeting while his expenses where stable and rising). Can't keep rolling over loans with this crowd. The golf courses which were ego plays are going to be his ultimate downfall.

Now I love those cowboys, I love their gold

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

Re: Orange Duce

The T****ster has had a bad couple of days.

Failed to oust Cheney from her position as Republican Conference Chair.

Failed to save Greene’s positions on House committees.

Chickened out on testifying at his second impeachment trial.

And the deepest cut of all: lost his SAG card. Say it ain’t so, Donnie.

I hope he can still play himself in the upcoming film The Rise and Fall of Donald T****, especially the scenes shot in the prison cell.

Failed to oust Cheney from her position as Republican Conference Chair.

Failed to save Greene’s positions on House committees.

Chickened out on testifying at his second impeachment trial.

And the deepest cut of all: lost his SAG card. Say it ain’t so, Donnie.

I hope he can still play himself in the upcoming film The Rise and Fall of Donald T****, especially the scenes shot in the prison cell.

Re: Orange Duce

Anybody who knows him knows that lies naturally gush forth from his mouth. Combine that with the fact that he was gonna be under oath, and you have a sure-fire recipe for perjury. So, chickening out or self-preservation (or all of the above)? Still, we can hope that some modicum of justice exists in this tattered country, which would certainly mean that he dies alone in a jail cell.

Re: Orange Duce

I'll be satisfied after he testifies for 11 hours in a hearing.