I was just in South Korea...that also have issues: https://news.cgtn.com/news/2023-03-15/V ... index.html

What a difference a year makes Feb 2022: https://www.reuters.com/world/asia-paci ... 022-03-01/

The Nation's Financial Condition

- youthathletics

- Posts: 15819

- Joined: Mon Jul 30, 2018 7:36 pm

Re: The Nation's Financial Condition

A fraudulent intent, however carefully concealed at the outset, will generally, in the end, betray itself.

~Livy

“There are two ways to be fooled. One is to believe what isn’t true; the other is to refuse to believe what is true.” -Soren Kierkegaard

~Livy

“There are two ways to be fooled. One is to believe what isn’t true; the other is to refuse to believe what is true.” -Soren Kierkegaard

-

Farfromgeneva

- Posts: 23818

- Joined: Sat Feb 23, 2019 10:53 am

Re: The Nation's Financial Condition

Watch this over the next 6-12mo. Hearing the regulators are going to start slapping orders on > 1/2 the banks they examine this year. C&Ds and MOUs which greatly restrict the bank at hand from acting on lending or other banking activities.

https://occ.gov/news-issuances/news-rel ... 23-46.html

This is an example of what one looks like:

https://www.occ.gov/static/enforcement- ... 23-008.pdf

https://occ.gov/news-issuances/news-rel ... 23-46.html

This is an example of what one looks like:

https://www.occ.gov/static/enforcement- ... 23-008.pdf

Now I love those cowboys, I love their gold

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

-

Farfromgeneva

- Posts: 23818

- Joined: Sat Feb 23, 2019 10:53 am

Re: The Nation's Financial Condition

https://mercercapital.com/auto-dealer-v ... -programs/

Interesting read on data privacy requirements for secondary market of EVs

Key Takeaways for Our Clients

Navigating the current environment can be challenging for auto dealers and their legal counsel. Some key decisions and issues are no longer on the distant horizon and must be addressed sooner rather than later. Some of these issues include the following.

Infrastructure Investments for EVs and EV Adoption Plans

Many OEMs require that their franchised dealers make significant investments in charging infrastructure and service equipment to support EV sales. In some cases, these investments are estimated to cost as much as $1 million per rooftop. Across the country, EV adoption plans rolled out by several manufacturers are under legal scrutiny. Many claim that all franchised dealers have a right to receive and sell any vehicles, regardless of powertrain, under current franchise agreements.

Another more nuanced issue is the creation of new EV-specific brands by OEMs (like Hyundai and Ioniq, for example). The introduction of these new brands could potentially lead to legal complexities. This is due to a potential loophole where dealerships are not obligated to supply electric vehicles (EVs) to their franchises because the vehicles bear a new and different brand name. If regulators and the legal system decide that creating a new brand is an acceptable reason to cut out dealers in favor of a direct sales model, the impacts of this precedent would be far-reaching.

Other dealer groups are pushing back on their OEM’s plans to sell certain models exclusively online, claiming a violation of current franchise agreements and franchise law. Time will tell how these legal battles play out, as the precedents set by these rulings could set the tone for future EV adoption.

Compliance with Data Privacy and Consumer Data Protection Laws

Data privacy laws that have historically applied to computers and smartphones are now being applied to the new age of tech-savvy vehicles and complex data storage systems within auto dealerships. These laws have come in response to the increasing technology in today’s new vehicles. The cost of compliance for dealers is significant, but the possible fines in the event of violations would certainly outweigh the costs of compliance.

Potential (and Active) Dealership Buyback Programs

Buick has offered to buy dealerships that do not wish to invest in the infrastructure to sell EVs. Will other manufacturers follow suit? These types of offers may present challenging choices for auto dealers. However, having a wider range of options generally has few disadvantages.

Interesting read on data privacy requirements for secondary market of EVs

Key Takeaways for Our Clients

Navigating the current environment can be challenging for auto dealers and their legal counsel. Some key decisions and issues are no longer on the distant horizon and must be addressed sooner rather than later. Some of these issues include the following.

Infrastructure Investments for EVs and EV Adoption Plans

Many OEMs require that their franchised dealers make significant investments in charging infrastructure and service equipment to support EV sales. In some cases, these investments are estimated to cost as much as $1 million per rooftop. Across the country, EV adoption plans rolled out by several manufacturers are under legal scrutiny. Many claim that all franchised dealers have a right to receive and sell any vehicles, regardless of powertrain, under current franchise agreements.

Another more nuanced issue is the creation of new EV-specific brands by OEMs (like Hyundai and Ioniq, for example). The introduction of these new brands could potentially lead to legal complexities. This is due to a potential loophole where dealerships are not obligated to supply electric vehicles (EVs) to their franchises because the vehicles bear a new and different brand name. If regulators and the legal system decide that creating a new brand is an acceptable reason to cut out dealers in favor of a direct sales model, the impacts of this precedent would be far-reaching.

Other dealer groups are pushing back on their OEM’s plans to sell certain models exclusively online, claiming a violation of current franchise agreements and franchise law. Time will tell how these legal battles play out, as the precedents set by these rulings could set the tone for future EV adoption.

Compliance with Data Privacy and Consumer Data Protection Laws

Data privacy laws that have historically applied to computers and smartphones are now being applied to the new age of tech-savvy vehicles and complex data storage systems within auto dealerships. These laws have come in response to the increasing technology in today’s new vehicles. The cost of compliance for dealers is significant, but the possible fines in the event of violations would certainly outweigh the costs of compliance.

Potential (and Active) Dealership Buyback Programs

Buick has offered to buy dealerships that do not wish to invest in the infrastructure to sell EVs. Will other manufacturers follow suit? These types of offers may present challenging choices for auto dealers. However, having a wider range of options generally has few disadvantages.

Now I love those cowboys, I love their gold

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

Re: The Nation's Financial Condition

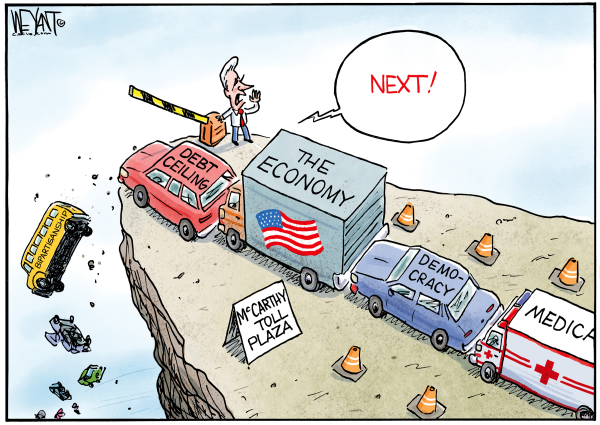

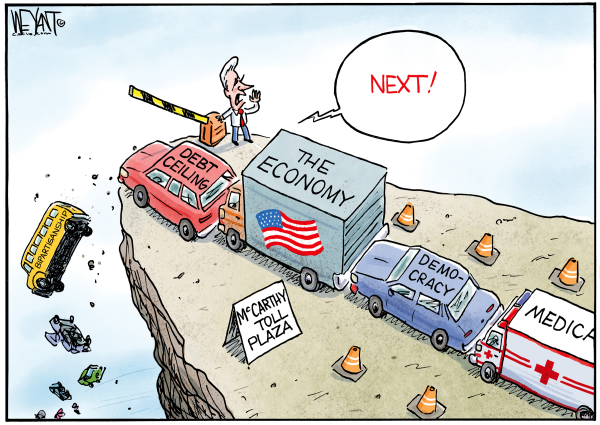

Leave to the RepubliCONs to screw the economy:

and, of course, to screw everything else.

and, of course, to screw everything else.

It has been proven a hundred times that the surest way to the heart of any man, black or white, honest or dishonest, is through justice and fairness.

Charles Francis "Socker" Coe, Esq

Charles Francis "Socker" Coe, Esq

-

Farfromgeneva

- Posts: 23818

- Joined: Sat Feb 23, 2019 10:53 am

Re: The Nation's Financial Condition

Little stale like a few days to week old but the regulators slapped the s**t out of cross river bank which is the largest and first true sponsor bank to fintech and related non bank lenders (sponsor banks allow lenders to obtain true lender status and National loans fall under the banks rules though they usually don’t own the credit risk it just passes through their hands for a few minutes to end owners. (“Forward flow Lon receivable asset purchasers”). Going to have a profound impact on the shadow banking universe. (See upstart recent deal with Castlelake out of Min rap plus if interested in this stuff - https://www.abladvisor.com/news/36447/c ... ment-loans)

May 17, 2023

In Cross River Consent Order, FDIC Focuses on Marketplace Lending and Third Party Lending Issues

Gary Bronstein, Christina Gattuso, Ross Speier, Agnes Trenche Mora

Kilpatrick Townsend & Stockton LLP

+ Follow Contact

The Federal Deposit Insurance Corporation (“FDIC”) recently entered into a consent order with Cross River Bank (“CRB”) addressing what the FDIC considered to be unsafe and unsound banking practices associated with CRB’s fair lending compliance.

The consent order, which was published in April on the FDIC’s website, required CRB to take extensive corrective actions. With CRB being a known banking partner of fintechs – having recently partnered with Circle in connection with the automatic settlement of Circle’s USDC stablecoin – the consent order has prompted questions on whether heightened regulatory action is on the horizon for financial institutions with marketplace lending and credit products offered in collaboration with third parties. This alert discusses certain consent order provisions related to CRB’s third party-facilitated lending that may be of note for financial institutions with similar operations, or any bank that is considering partnering with fintechs to provide banking-as-a-service.

At a high level, the consent order requires CRB to do the following:

Strengthen marketplace lending and third party compliance controls. CRB was tasked with increasing supervision and oversight of internal controls, information systems, credit underwriting practices and internal audit systems relating to its marketplace lending, and also developing its third party compliance internal controls.

Comply with credit product and third party disclosure and non-objection processes. CRB must identify credit products offered by, or in conjunction with, CRB (“CRB Credit Products”), identify all third parties that offer CRB Credit Products, and seek the FDIC’s non-objection before offering new credit products or partnering with new third parties.

Prepare assessments and reports regarding information systems and fair lending. CRB must engage independent third parties acceptable to the FDIC to prepare certain assessments and reports regarding CRB’s information systems and fair lending compliance.

Below are areas of concern highlighted by the FDIC in connection with CRB’s credit offerings:

Fair Lending Compliance When Using Automated Processes and Systems for Credit Decisions. The consent order required improvements to CRB’s internal controls for its Marketplace Lending. Cross River’s website describes Marketplace Lending as a platform that “accepts applications for a wide variety of loans and determines an applicant’s creditworthiness using an automated algorithm.” CRB originates loans that are issued to consumers and small businesses through CRB’s lending partners.

The FDIC required periodic risk-based fair lending assessments of marketplace lending activities, with assessments that are “well supported by qualitative and quantitative data.” In addition, the FDIC’s consent order imposed requirements aimed at ensuring automated processes used in CRB credit decisions are adequately examined and assessed for compliance with fair lending requirements. For example, the consent order provides that the independent third party evaluation of CRB’s information systems must assess if data on CRB’s credit products and data on “any models or systems, including any variables or weightings, used or relied on in connection with a credit product” is sufficiently complete, accurate and accessible to permit CRB to appropriately monitor compliance of the credit products, third parties and credit models with all applicable fair lending laws and regulations. In addition, the independent third party evaluation of CRB’s fair lending practices must consider and analyze CRB’s use of “non-staff resources, including software, automated systems, and/or other technology” in connection with lending decisions, and “assess the adequacy and effectiveness” of non-staff resources in supporting the fair lending compliance requirements of the bank.

Robust Third Party Due Diligence Requirements. The consent order’s non-objection requirements imposed in-depth due diligence obligations on CRB in connection with offering new credit products or permitting new third parties to offer its products. To partner with a new third party, CRB must provide the FDIC with (i) a draft of the proposed written agreement between CRB and the new third party, (ii) a third party risk assessment that evaluates, among other things, the third party’s internal controls, internal audit functions, and any models or systems the third party employs in connection with a credit product, (iii) a written assessment from the CRB board on whether the third party meets CRB’s due diligence standards, and (iv) descriptions of the procedures CRB will use to evaluate and monitor the third party’s fair lending compliance and compliance with the recordkeeping and informational requirements set out in the consent order. In addition, CRB is required to have processes in place to assess at least annually whether each of the third parties offering CRB Credit Products are in compliance with fair lending requirements.

Marketing Decisions Related to Credit Products. Under the consent order, CRB is expected to consider the marketing associated with its credit products as part of its fair lending compliance obligations. This includes considering the terms and conditions describing a credit product in its own marketing materials, contractually requiring the recordkeeping of marketing materials in its agreements with new third parties, and overseeing the terms and conditions in marketing materials regarding a credit product that are distributed by a third party.

The consent order highlights features of fair lending processes and procedures that the FDIC considered relevant in connection with CRB’s offer of credit products in collaboration with third parties. The FDIC directive to implement additional compliance management system controls required not only ensuring that CRB’s products and services comply with fair lending laws, but also the Truth in Lending Act, the Electronic Fund Transfer Act, and more generally, Section 5 of the FTC Act, which indicates the FDIC’s findings here may apply to other aspects of banking-as-a-service.

Banks with credit product arrangements like CRB, and those who are partnering with, or considering partnering with, fintechs may wish to examine their internal controls, due diligence, and information systems processes in the context of the directives identified in the Cross River consent order. Specifically, banks may consider implementing the following aspects of the written compliance program mandated by the FDIC as part of the consent order:

policies that address the bank’s products and services and related consumer protection risks which are designed to ensure compliance with consumer protection laws,

training that provides comprehensive education in applicable consumer protection laws and bank policies to employees,

monitoring that regularly reviews bank business units and operations, products/services, and changes in applicable consumer protection laws,

a consumer complaint process that provides for timely identification, review, investigation, response to and resolution of all consumer complaints received by the bank and third-party providers, and

a consumer protection audit program that ensures an effective, independent, risk-based review is conducted of bank policies and product/services to determine compliance with consumer protection laws.

May 17, 2023

In Cross River Consent Order, FDIC Focuses on Marketplace Lending and Third Party Lending Issues

Gary Bronstein, Christina Gattuso, Ross Speier, Agnes Trenche Mora

Kilpatrick Townsend & Stockton LLP

+ Follow Contact

The Federal Deposit Insurance Corporation (“FDIC”) recently entered into a consent order with Cross River Bank (“CRB”) addressing what the FDIC considered to be unsafe and unsound banking practices associated with CRB’s fair lending compliance.

The consent order, which was published in April on the FDIC’s website, required CRB to take extensive corrective actions. With CRB being a known banking partner of fintechs – having recently partnered with Circle in connection with the automatic settlement of Circle’s USDC stablecoin – the consent order has prompted questions on whether heightened regulatory action is on the horizon for financial institutions with marketplace lending and credit products offered in collaboration with third parties. This alert discusses certain consent order provisions related to CRB’s third party-facilitated lending that may be of note for financial institutions with similar operations, or any bank that is considering partnering with fintechs to provide banking-as-a-service.

At a high level, the consent order requires CRB to do the following:

Strengthen marketplace lending and third party compliance controls. CRB was tasked with increasing supervision and oversight of internal controls, information systems, credit underwriting practices and internal audit systems relating to its marketplace lending, and also developing its third party compliance internal controls.

Comply with credit product and third party disclosure and non-objection processes. CRB must identify credit products offered by, or in conjunction with, CRB (“CRB Credit Products”), identify all third parties that offer CRB Credit Products, and seek the FDIC’s non-objection before offering new credit products or partnering with new third parties.

Prepare assessments and reports regarding information systems and fair lending. CRB must engage independent third parties acceptable to the FDIC to prepare certain assessments and reports regarding CRB’s information systems and fair lending compliance.

Below are areas of concern highlighted by the FDIC in connection with CRB’s credit offerings:

Fair Lending Compliance When Using Automated Processes and Systems for Credit Decisions. The consent order required improvements to CRB’s internal controls for its Marketplace Lending. Cross River’s website describes Marketplace Lending as a platform that “accepts applications for a wide variety of loans and determines an applicant’s creditworthiness using an automated algorithm.” CRB originates loans that are issued to consumers and small businesses through CRB’s lending partners.

The FDIC required periodic risk-based fair lending assessments of marketplace lending activities, with assessments that are “well supported by qualitative and quantitative data.” In addition, the FDIC’s consent order imposed requirements aimed at ensuring automated processes used in CRB credit decisions are adequately examined and assessed for compliance with fair lending requirements. For example, the consent order provides that the independent third party evaluation of CRB’s information systems must assess if data on CRB’s credit products and data on “any models or systems, including any variables or weightings, used or relied on in connection with a credit product” is sufficiently complete, accurate and accessible to permit CRB to appropriately monitor compliance of the credit products, third parties and credit models with all applicable fair lending laws and regulations. In addition, the independent third party evaluation of CRB’s fair lending practices must consider and analyze CRB’s use of “non-staff resources, including software, automated systems, and/or other technology” in connection with lending decisions, and “assess the adequacy and effectiveness” of non-staff resources in supporting the fair lending compliance requirements of the bank.

Robust Third Party Due Diligence Requirements. The consent order’s non-objection requirements imposed in-depth due diligence obligations on CRB in connection with offering new credit products or permitting new third parties to offer its products. To partner with a new third party, CRB must provide the FDIC with (i) a draft of the proposed written agreement between CRB and the new third party, (ii) a third party risk assessment that evaluates, among other things, the third party’s internal controls, internal audit functions, and any models or systems the third party employs in connection with a credit product, (iii) a written assessment from the CRB board on whether the third party meets CRB’s due diligence standards, and (iv) descriptions of the procedures CRB will use to evaluate and monitor the third party’s fair lending compliance and compliance with the recordkeeping and informational requirements set out in the consent order. In addition, CRB is required to have processes in place to assess at least annually whether each of the third parties offering CRB Credit Products are in compliance with fair lending requirements.

Marketing Decisions Related to Credit Products. Under the consent order, CRB is expected to consider the marketing associated with its credit products as part of its fair lending compliance obligations. This includes considering the terms and conditions describing a credit product in its own marketing materials, contractually requiring the recordkeeping of marketing materials in its agreements with new third parties, and overseeing the terms and conditions in marketing materials regarding a credit product that are distributed by a third party.

The consent order highlights features of fair lending processes and procedures that the FDIC considered relevant in connection with CRB’s offer of credit products in collaboration with third parties. The FDIC directive to implement additional compliance management system controls required not only ensuring that CRB’s products and services comply with fair lending laws, but also the Truth in Lending Act, the Electronic Fund Transfer Act, and more generally, Section 5 of the FTC Act, which indicates the FDIC’s findings here may apply to other aspects of banking-as-a-service.

Banks with credit product arrangements like CRB, and those who are partnering with, or considering partnering with, fintechs may wish to examine their internal controls, due diligence, and information systems processes in the context of the directives identified in the Cross River consent order. Specifically, banks may consider implementing the following aspects of the written compliance program mandated by the FDIC as part of the consent order:

policies that address the bank’s products and services and related consumer protection risks which are designed to ensure compliance with consumer protection laws,

training that provides comprehensive education in applicable consumer protection laws and bank policies to employees,

monitoring that regularly reviews bank business units and operations, products/services, and changes in applicable consumer protection laws,

a consumer complaint process that provides for timely identification, review, investigation, response to and resolution of all consumer complaints received by the bank and third-party providers, and

a consumer protection audit program that ensures an effective, independent, risk-based review is conducted of bank policies and product/services to determine compliance with consumer protection laws.

Now I love those cowboys, I love their gold

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

-

Farfromgeneva

- Posts: 23818

- Joined: Sat Feb 23, 2019 10:53 am

Re: The Nation's Financial Condition

Yes, a College Degree Is Still Worth It

College graduates continue to command higher wages, but to combat falling enrollment, schools need to emphasize skills over credentials

By Jeffrey Selingo and Matt Sigelman

May 20, 2023 12:01 am ET

This month, even as some two million bachelor’s degrees are awarded at college commencements in the U.S., the credential itself faces an identity crisis.

In the last year and a half, Maryland, Pennsylvania, New Jersey and Utah have stopped requiring a four-year degree for most jobs in their state governments. The private sector has also moved toward skill-based hiring, with Google, Apple, IBM, Delta and General Motors, among others, dropping the four-year degree as a prerequisite for many positions. Even the federal government is urging its agencies to fill vacancies based on job-seekers’ skills rather than on their college credentials.

Some of these moves are the result of a tight labor market after the pandemic, but the push to lower the degree barrier long predates Covid. Its advocates see it as a way to remedy structural inequities in the job market and to combat the “degree inflation”—requiring a bachelor’s degree for jobs that historically haven’t—that accelerated after the recession of 2007-09. According to a report published last year by the Burning Glass Institute, degree requirements became significantly less common in 46% of middle-skill jobs and 31% of high-skill jobs between 2017 and 2019—a major reset in employers’ assumptions about the necessity of a diploma.

Advertisement - Scroll to Continue

Ten years ago, 74% of 18-29 year olds said that it was very important to get a degree. Today, only 41% agree.

This shift has fed the notion that college, and the bachelor’s degree in particular, isn’t necessary for a successful career. According to Gallup, 10 years ago, 74% of 18-29 year olds said that it was very important to get a degree. Today, only 41% agree. Young adults are getting mixed messages about what kind of education they need after high school—and whether they need more training at all.

Newsletter Sign-up

Grapevine

A weekly look at our most colorful, thought-provoking and original feature stories on the business of life.

The result is that undergraduate enrollment in the U.S. has fallen each year since it peaked in 2010-11, with an especially sharp drop in the first full year of the pandemic. Nationwide, fewer high-school seniors are choosing to enroll in college immediately after graduation. In 2022, only 62% of high school graduates went immediately to college. In some states, not even half of high school graduates are pursuing higher education.

Even in a degree-optional world, however, it’s a mistake for students and their parents to think that college isn’t necessary. A study we recently completed using data from Lightcast, a labor-market analytics firm, found that the four-year degree is still a valuable commodity, delivering an immediate 25% wage premium within a year of graduation—a difference that held steady over the 12-year period we studied. What’s more, we found that having a degree makes it easier for graduates to recover from early career struggles, allowing those who are “underemployed” to move up more easily into jobs where more of their co-workers have a degree.

Still, it would also be a mistake for colleges and universities to simply coast on the degree’s legacy as an economic driver for graduates. Our research shows that what employers want out of the degree has changed, and colleges need to rethink the credential so that their graduates can better compete in today’s job market.

Advertisement - Scroll to Continue

The economic value of a bachelor’s degree has typically depended on the prestige of the college and the market demand for certain majors. While that generally remains true, we also found that a third ingredient is critical to the ultimate payoff: the specific skills students leave college with.

In decades past, employers looked to degrees as indicators of basic capability, training new hires with required skills. Today, people are less likely to stick with a job, so firms expect employees to arrive ready for work.

SHARE YOUR THOUGHTS

Do you think going to college is still a good investment? Join the conversation below.

The problem is that colleges tend to speak the language of “learning outcomes” instead of skills. It’s not just a matter of what is lost in translation. The absence of a common vocabulary between industry and higher education often makes it difficult to add to the curriculum the skills that can put graduates ahead.

To make a degree more valuable, higher education must spell out the skills that students learn on campus and help them to see where those skills are needed in the workforce. Sometimes this sort of exercise reveals unexpected relevance. When the University of Central Florida compared the skills taught in each of its programs of study with the skills sought by employers, it discovered, for example, that its gender studies majors had acquired extensive experience in project management as preparation for field work, a skill that boosts graduate earnings by 22%.

While colleges like to stuff the bachelor’s degree with course requirements, sometimes just one skill delivers big value. For instance, a public administration major who also has investment skills can see their wage premium rise by nearly a third, while a liberal-arts major who is knowledgeable about strategic planning gets a 20% boost.

Advertisement - Scroll to Continue

Eugene Thomas at Yale University, where he graduated in 2022 with a degree in Mechanical Engineering and a certificate in Statistics and Data Science. The economic value of a bachelor’s degree has typically depended on the prestige of the college and the market demand for certain majors, but today employers are also looking for graduates with specific skills. Photo: Christopher Capozziello for The Wall Street Journal

Some of the most valuable skills are those that are just emerging in a particular field but are still relatively scarce. Knowing SQL, a database language, delivers an 11% wage premium for a natural resources major (where SQL is a relatively rare skill) but only a 4% return for a math major (where SQL is relatively common). Foundational skills—the bedrock of a liberal arts education—sometimes pay off even more than technical capabilities. Business majors get a greater wage boost from skills in negotiation and influencing others than from studying accounting.

What’s clear is that a degree by itself no longer signals that college graduates have the skills employers are looking for. That’s why the University of Texas system is beginning to embed “microcredentials”—ranging from data analysis to project management—into the four-year degree, starting with some of its lowest-earning majors.

Last fall, the University of Minnesota at Rochester started offering a two-and-a-half year bachelor’s degree in health sciences. It combines in-person and virtual classes, guarantees paid internships at the nearby Mayo Clinic and allows students to track their progress in a digital portfolio, for easy use in explaining to potential employers what they have learned in their classes.

This fall, Georgetown University is starting a bachelor’s degree in environment and sustainability. The first two years provide students with an “integrated experience,” combining the liberal arts with specialized skills for the major. Credit-bearing “immersions,” such as internships and research projects, are built into the beginning and end of the semesters. The final week focuses on helping students understand the knowledge and skills they developed across their courses.

In the 1980s, when college credentials were still relatively rare, a bachelor’s degree was a key differentiating factor for newcomers to the job market. Today, for students facing rising costs and growing debt, it’s not as much of a slam dunk. Where the degree is from, what it’s in and what skills you learn matter far more. To make the degree more valuable for more students, colleges need to bring new focus to how students fare after graduation. The bachelor’s degree needs to be remade for our increasingly degree-optional world.

Jeffrey Selingo is the author of “Who Gets In and Why: A Year Inside College Admissions” and a special adviser and professor of practice at Arizona State University. Matt Sigelman is president of the Burning Glass Institute and a visiting fellow at the Harvard Kennedy School’s Project on the Workforce.

Advertisement - Scroll to Continue

College graduates continue to command higher wages, but to combat falling enrollment, schools need to emphasize skills over credentials

By Jeffrey Selingo and Matt Sigelman

May 20, 2023 12:01 am ET

This month, even as some two million bachelor’s degrees are awarded at college commencements in the U.S., the credential itself faces an identity crisis.

In the last year and a half, Maryland, Pennsylvania, New Jersey and Utah have stopped requiring a four-year degree for most jobs in their state governments. The private sector has also moved toward skill-based hiring, with Google, Apple, IBM, Delta and General Motors, among others, dropping the four-year degree as a prerequisite for many positions. Even the federal government is urging its agencies to fill vacancies based on job-seekers’ skills rather than on their college credentials.

Some of these moves are the result of a tight labor market after the pandemic, but the push to lower the degree barrier long predates Covid. Its advocates see it as a way to remedy structural inequities in the job market and to combat the “degree inflation”—requiring a bachelor’s degree for jobs that historically haven’t—that accelerated after the recession of 2007-09. According to a report published last year by the Burning Glass Institute, degree requirements became significantly less common in 46% of middle-skill jobs and 31% of high-skill jobs between 2017 and 2019—a major reset in employers’ assumptions about the necessity of a diploma.

Advertisement - Scroll to Continue

Ten years ago, 74% of 18-29 year olds said that it was very important to get a degree. Today, only 41% agree.

This shift has fed the notion that college, and the bachelor’s degree in particular, isn’t necessary for a successful career. According to Gallup, 10 years ago, 74% of 18-29 year olds said that it was very important to get a degree. Today, only 41% agree. Young adults are getting mixed messages about what kind of education they need after high school—and whether they need more training at all.

Newsletter Sign-up

Grapevine

A weekly look at our most colorful, thought-provoking and original feature stories on the business of life.

The result is that undergraduate enrollment in the U.S. has fallen each year since it peaked in 2010-11, with an especially sharp drop in the first full year of the pandemic. Nationwide, fewer high-school seniors are choosing to enroll in college immediately after graduation. In 2022, only 62% of high school graduates went immediately to college. In some states, not even half of high school graduates are pursuing higher education.

Even in a degree-optional world, however, it’s a mistake for students and their parents to think that college isn’t necessary. A study we recently completed using data from Lightcast, a labor-market analytics firm, found that the four-year degree is still a valuable commodity, delivering an immediate 25% wage premium within a year of graduation—a difference that held steady over the 12-year period we studied. What’s more, we found that having a degree makes it easier for graduates to recover from early career struggles, allowing those who are “underemployed” to move up more easily into jobs where more of their co-workers have a degree.

Still, it would also be a mistake for colleges and universities to simply coast on the degree’s legacy as an economic driver for graduates. Our research shows that what employers want out of the degree has changed, and colleges need to rethink the credential so that their graduates can better compete in today’s job market.

Advertisement - Scroll to Continue

The economic value of a bachelor’s degree has typically depended on the prestige of the college and the market demand for certain majors. While that generally remains true, we also found that a third ingredient is critical to the ultimate payoff: the specific skills students leave college with.

In decades past, employers looked to degrees as indicators of basic capability, training new hires with required skills. Today, people are less likely to stick with a job, so firms expect employees to arrive ready for work.

SHARE YOUR THOUGHTS

Do you think going to college is still a good investment? Join the conversation below.

The problem is that colleges tend to speak the language of “learning outcomes” instead of skills. It’s not just a matter of what is lost in translation. The absence of a common vocabulary between industry and higher education often makes it difficult to add to the curriculum the skills that can put graduates ahead.

To make a degree more valuable, higher education must spell out the skills that students learn on campus and help them to see where those skills are needed in the workforce. Sometimes this sort of exercise reveals unexpected relevance. When the University of Central Florida compared the skills taught in each of its programs of study with the skills sought by employers, it discovered, for example, that its gender studies majors had acquired extensive experience in project management as preparation for field work, a skill that boosts graduate earnings by 22%.

While colleges like to stuff the bachelor’s degree with course requirements, sometimes just one skill delivers big value. For instance, a public administration major who also has investment skills can see their wage premium rise by nearly a third, while a liberal-arts major who is knowledgeable about strategic planning gets a 20% boost.

Advertisement - Scroll to Continue

Eugene Thomas at Yale University, where he graduated in 2022 with a degree in Mechanical Engineering and a certificate in Statistics and Data Science. The economic value of a bachelor’s degree has typically depended on the prestige of the college and the market demand for certain majors, but today employers are also looking for graduates with specific skills. Photo: Christopher Capozziello for The Wall Street Journal

Some of the most valuable skills are those that are just emerging in a particular field but are still relatively scarce. Knowing SQL, a database language, delivers an 11% wage premium for a natural resources major (where SQL is a relatively rare skill) but only a 4% return for a math major (where SQL is relatively common). Foundational skills—the bedrock of a liberal arts education—sometimes pay off even more than technical capabilities. Business majors get a greater wage boost from skills in negotiation and influencing others than from studying accounting.

What’s clear is that a degree by itself no longer signals that college graduates have the skills employers are looking for. That’s why the University of Texas system is beginning to embed “microcredentials”—ranging from data analysis to project management—into the four-year degree, starting with some of its lowest-earning majors.

Last fall, the University of Minnesota at Rochester started offering a two-and-a-half year bachelor’s degree in health sciences. It combines in-person and virtual classes, guarantees paid internships at the nearby Mayo Clinic and allows students to track their progress in a digital portfolio, for easy use in explaining to potential employers what they have learned in their classes.

This fall, Georgetown University is starting a bachelor’s degree in environment and sustainability. The first two years provide students with an “integrated experience,” combining the liberal arts with specialized skills for the major. Credit-bearing “immersions,” such as internships and research projects, are built into the beginning and end of the semesters. The final week focuses on helping students understand the knowledge and skills they developed across their courses.

In the 1980s, when college credentials were still relatively rare, a bachelor’s degree was a key differentiating factor for newcomers to the job market. Today, for students facing rising costs and growing debt, it’s not as much of a slam dunk. Where the degree is from, what it’s in and what skills you learn matter far more. To make the degree more valuable for more students, colleges need to bring new focus to how students fare after graduation. The bachelor’s degree needs to be remade for our increasingly degree-optional world.

Jeffrey Selingo is the author of “Who Gets In and Why: A Year Inside College Admissions” and a special adviser and professor of practice at Arizona State University. Matt Sigelman is president of the Burning Glass Institute and a visiting fellow at the Harvard Kennedy School’s Project on the Workforce.

Advertisement - Scroll to Continue

Now I love those cowboys, I love their gold

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

- youthathletics

- Posts: 15819

- Joined: Mon Jul 30, 2018 7:36 pm

Re: The Nation's Financial Condition

Can it be summed up as the dog chasing its tail with the exception of some STEM schools/programs?Farfromgeneva wrote: ↑Sat May 20, 2023 7:53 am College graduates continue to command higher wages, but to combat falling enrollment, schools need to emphasize skills over credentials

By Jeffrey Selingo and Matt Sigelman

May 20, 2023 12:01 am ET

In the end, those 4 years a student is in school (6-7 if you play lacrosse

A fraudulent intent, however carefully concealed at the outset, will generally, in the end, betray itself.

~Livy

“There are two ways to be fooled. One is to believe what isn’t true; the other is to refuse to believe what is true.” -Soren Kierkegaard

~Livy

“There are two ways to be fooled. One is to believe what isn’t true; the other is to refuse to believe what is true.” -Soren Kierkegaard

-

Typical Lax Dad

- Posts: 34084

- Joined: Mon Jul 30, 2018 12:10 pm

Re: The Nation's Financial Condition

You can advise the kids that you know to not go to college….I will advise the kids that I know to go to college.youthathletics wrote: ↑Sat May 20, 2023 8:50 amCan it be summed up as the dog chasing its tail with the exception of some STEM schools/programs?Farfromgeneva wrote: ↑Sat May 20, 2023 7:53 am College graduates continue to command higher wages, but to combat falling enrollment, schools need to emphasize skills over credentials

By Jeffrey Selingo and Matt Sigelman

May 20, 2023 12:01 am ET

In the end, those 4 years a student is in school (6-7 if you play lacrosse) , are really a place for businesses to weed out wasting an investment in someone younger out of HS to mentor and apprentice them via OJT via immersion. And, if they go straight into the workforce, while they are working, they can take those micro certifications, like Microsoft database certs, or environmental certs, etc.

“I wish you would!”

Re: The Nation's Financial Condition

Should we forego the idea off a graduate degree for medicine or law or science or …..Typical Lax Dad wrote: ↑Sat May 20, 2023 9:01 amYou can advise the kids that you know to not go to college….I will advise the kids that I know to go to college.youthathletics wrote: ↑Sat May 20, 2023 8:50 amCan it be summed up as the dog chasing its tail with the exception of some STEM schools/programs?Farfromgeneva wrote: ↑Sat May 20, 2023 7:53 am College graduates continue to command higher wages, but to combat falling enrollment, schools need to emphasize skills over credentials

By Jeffrey Selingo and Matt Sigelman

May 20, 2023 12:01 am ET

In the end, those 4 years a student is in school (6-7 if you play lacrosse) , are really a place for businesses to weed out wasting an investment in someone younger out of HS to mentor and apprentice them via OJT via immersion. And, if they go straight into the workforce, while they are working, they can take those micro certifications, like Microsoft database certs, or environmental certs, etc.

- youthathletics

- Posts: 15819

- Joined: Mon Jul 30, 2018 7:36 pm

Re: The Nation's Financial Condition

...you missed the entire point.Typical Lax Dad wrote: ↑Sat May 20, 2023 9:01 amYou can advise the kids that you know to not go to college….I will advise the kids that I know to go to college.youthathletics wrote: ↑Sat May 20, 2023 8:50 amCan it be summed up as the dog chasing its tail with the exception of some STEM schools/programs?Farfromgeneva wrote: ↑Sat May 20, 2023 7:53 am College graduates continue to command higher wages, but to combat falling enrollment, schools need to emphasize skills over credentials

By Jeffrey Selingo and Matt Sigelman

May 20, 2023 12:01 am ET

In the end, those 4 years a student is in school (6-7 if you play lacrosse) , are really a place for businesses to weed out wasting an investment in someone younger out of HS to mentor and apprentice them via OJT via immersion. And, if they go straight into the workforce, while they are working, they can take those micro certifications, like Microsoft database certs, or environmental certs, etc.

A fraudulent intent, however carefully concealed at the outset, will generally, in the end, betray itself.

~Livy

“There are two ways to be fooled. One is to believe what isn’t true; the other is to refuse to believe what is true.” -Soren Kierkegaard

~Livy

“There are two ways to be fooled. One is to believe what isn’t true; the other is to refuse to believe what is true.” -Soren Kierkegaard

-

Typical Lax Dad

- Posts: 34084

- Joined: Mon Jul 30, 2018 12:10 pm

Re: The Nation's Financial Condition

The point is you ain’t said nothing new. College isn’t for everyone but you better have something beyond a HS diploma. Data has shown that going to college pays. The ROI far exceeds equity market returns. I have mentioned a couple of times kids that I have advised kids to pursue a trade first. One kid was a HVAC technician before going to PWC…..guess which career offers him more upside? Again, college isn’t for everyone. Friends son played NEC lacrosse…worked for a financial service company out of college and didn’t like it….became a firefighter….nowyouthathletics wrote: ↑Sat May 20, 2023 9:20 am...you missed the entire point.Typical Lax Dad wrote: ↑Sat May 20, 2023 9:01 amYou can advise the kids that you know to not go to college….I will advise the kids that I know to go to college.youthathletics wrote: ↑Sat May 20, 2023 8:50 amCan it be summed up as the dog chasing its tail with the exception of some STEM schools/programs?Farfromgeneva wrote: ↑Sat May 20, 2023 7:53 am College graduates continue to command higher wages, but to combat falling enrollment, schools need to emphasize skills over credentials

By Jeffrey Selingo and Matt Sigelman

May 20, 2023 12:01 am ET

In the end, those 4 years a student is in school (6-7 if you play lacrosse) , are really a place for businesses to weed out wasting an investment in someone younger out of HS to mentor and apprentice them via OJT via immersion. And, if they go straight into the workforce, while they are working, they can take those micro certifications, like Microsoft database certs, or environmental certs, etc.

Trying to get back into financial services…..Michigan recruiting him for lax but dad didn’t want him to go because he wouldn’t be able to get to as many games. An electrician and his weekend schedule isn’t flexible. I tried to convince him to send his kid to Michigan….I trained his kid growing up and coached him in hoops. Excellent defender, BTW.

“I wish you would!”

-

Typical Lax Dad

- Posts: 34084

- Joined: Mon Jul 30, 2018 12:10 pm

Re: The Nation's Financial Condition

It is a waste of time….whatever happened to COVID proving we don’t need colleges and these high end schools imploding…..Parents and kids couldn’t get back to college campuses fast enoughOCanada wrote: ↑Sat May 20, 2023 9:11 amShould we forego the idea off a graduate degree for medicine or law or science or …..Typical Lax Dad wrote: ↑Sat May 20, 2023 9:01 amYou can advise the kids that you know to not go to college….I will advise the kids that I know to go to college.youthathletics wrote: ↑Sat May 20, 2023 8:50 amCan it be summed up as the dog chasing its tail with the exception of some STEM schools/programs?Farfromgeneva wrote: ↑Sat May 20, 2023 7:53 am College graduates continue to command higher wages, but to combat falling enrollment, schools need to emphasize skills over credentials

By Jeffrey Selingo and Matt Sigelman

May 20, 2023 12:01 am ET

In the end, those 4 years a student is in school (6-7 if you play lacrosse) , are really a place for businesses to weed out wasting an investment in someone younger out of HS to mentor and apprentice them via OJT via immersion. And, if they go straight into the workforce, while they are working, they can take those micro certifications, like Microsoft database certs, or environmental certs, etc.

“I wish you would!”

- youthathletics

- Posts: 15819

- Joined: Mon Jul 30, 2018 7:36 pm

Re: The Nation's Financial Condition

....still missing my point. My comment has nothing to do with the student, his ROI, or whether they are college material or not. It Is about business institutions, which we are hearing more and more about, bypassing the prerequisite to have a 4 year degree. An 18 y/o wanting to be a firefighter, a banker, an accountant.....can very well learn all they need while immersed in their craft, just as you and I each day with young minds.Typical Lax Dad wrote: ↑Sat May 20, 2023 9:57 amThe point is you ain’t said nothing new. College isn’t for everyone but you better have something beyond a HS diploma. Data has shown that going to college pays. The ROI far exceeds equity market returns......youthathletics wrote: ↑Sat May 20, 2023 9:20 am...you missed the entire point.Typical Lax Dad wrote: ↑Sat May 20, 2023 9:01 amYou can advise the kids that you know to not go to college….I will advise the kids that I know to go to college.youthathletics wrote: ↑Sat May 20, 2023 8:50 amCan it be summed up as the dog chasing its tail with the exception of some STEM schools/programs?Farfromgeneva wrote: ↑Sat May 20, 2023 7:53 am College graduates continue to command higher wages, but to combat falling enrollment, schools need to emphasize skills over credentials

By Jeffrey Selingo and Matt Sigelman

May 20, 2023 12:01 am ET

In the end, those 4 years a student is in school (6-7 if you play lacrosse) , are really a place for businesses to weed out wasting an investment in someone younger out of HS to mentor and apprentice them via OJT via immersion. And, if they go straight into the workforce, while they are working, they can take those micro certifications, like Microsoft database certs, or environmental certs, etc.

As an aside, I get young adults straight out college with ME/EE degrees from UMD, York, VT, ND and others, and also hire from the military. To be frank, the military hires always outperform the college grads. Then, as they navigate up the ladder, they are then 'forced/required' to hold an undergrad degree at a minimum, forcing them to enroll and check that box just to get to another level; which I believe the latter is to your point...the ROI. All I am saying, is if the businesses no longer required a degree (with the exception of some STEM), we would have far more people available to support challenging careers. Additionally, those that did not attain and undergrad or higher, seem to also become the overachievers...as witnessed by the ex-military we witness.

A fraudulent intent, however carefully concealed at the outset, will generally, in the end, betray itself.

~Livy

“There are two ways to be fooled. One is to believe what isn’t true; the other is to refuse to believe what is true.” -Soren Kierkegaard

~Livy

“There are two ways to be fooled. One is to believe what isn’t true; the other is to refuse to believe what is true.” -Soren Kierkegaard

-

Typical Lax Dad

- Posts: 34084

- Joined: Mon Jul 30, 2018 12:10 pm

Re: The Nation's Financial Condition

so most people that don’t go to college end up as overachievers?youthathletics wrote: ↑Sat May 20, 2023 11:35 am....still missing my point. My comment has nothing to do with the student, his ROI, or whether they are college material or not. It Is about business institutions, which we are hearing more and more about, bypassing the prerequisite to have a 4 year degree. An 18 y/o wanting to be a firefighter, a banker, an accountant.....can very well learn all they need while immersed in their craft, just as you and I each day with young minds.Typical Lax Dad wrote: ↑Sat May 20, 2023 9:57 amThe point is you ain’t said nothing new. College isn’t for everyone but you better have something beyond a HS diploma. Data has shown that going to college pays. The ROI far exceeds equity market returns......youthathletics wrote: ↑Sat May 20, 2023 9:20 am...you missed the entire point.Typical Lax Dad wrote: ↑Sat May 20, 2023 9:01 amYou can advise the kids that you know to not go to college….I will advise the kids that I know to go to college.youthathletics wrote: ↑Sat May 20, 2023 8:50 amCan it be summed up as the dog chasing its tail with the exception of some STEM schools/programs?Farfromgeneva wrote: ↑Sat May 20, 2023 7:53 am College graduates continue to command higher wages, but to combat falling enrollment, schools need to emphasize skills over credentials

By Jeffrey Selingo and Matt Sigelman

May 20, 2023 12:01 am ET

In the end, those 4 years a student is in school (6-7 if you play lacrosse) , are really a place for businesses to weed out wasting an investment in someone younger out of HS to mentor and apprentice them via OJT via immersion. And, if they go straight into the workforce, while they are working, they can take those micro certifications, like Microsoft database certs, or environmental certs, etc.

As an aside, I get young adults straight out college with ME/EE degrees from UMD, York, VT, ND and others, and also hire from the military. To be frank, the military hires always outperform the college grads. Then, as they navigate up the ladder, they are then 'forced/required' to hold an undergrad degree at a minimum, forcing them to enroll and check that box just to get to another level; which I believe the latter is to your point...the ROI. All I am saying, is if the businesses no longer required a degree (with the exception of some STEM), we would have far more people available to support challenging careers. Additionally, those that did not attain and undergrad or higher, seem to also become the overachievers...as witnessed by the ex-military we witness.

“I wish you would!”

- youthathletics

- Posts: 15819

- Joined: Mon Jul 30, 2018 7:36 pm

Re: The Nation's Financial Condition

Typical Lax Dad wrote: ↑Sat May 20, 2023 11:45 amso most people that don’t go to college end up as overachievers?youthathletics wrote: ↑Sat May 20, 2023 11:35 am....still missing my point. My comment has nothing to do with the student, his ROI, or whether they are college material or not. It Is about business institutions, which we are hearing more and more about, bypassing the prerequisite to have a 4 year degree. An 18 y/o wanting to be a firefighter, a banker, an accountant.....can very well learn all they need while immersed in their craft, just as you and I each day with young minds.Typical Lax Dad wrote: ↑Sat May 20, 2023 9:57 amThe point is you ain’t said nothing new. College isn’t for everyone but you better have something beyond a HS diploma. Data has shown that going to college pays. The ROI far exceeds equity market returns......youthathletics wrote: ↑Sat May 20, 2023 9:20 am...you missed the entire point.Typical Lax Dad wrote: ↑Sat May 20, 2023 9:01 amYou can advise the kids that you know to not go to college….I will advise the kids that I know to go to college.youthathletics wrote: ↑Sat May 20, 2023 8:50 amCan it be summed up as the dog chasing its tail with the exception of some STEM schools/programs?Farfromgeneva wrote: ↑Sat May 20, 2023 7:53 am College graduates continue to command higher wages, but to combat falling enrollment, schools need to emphasize skills over credentials

By Jeffrey Selingo and Matt Sigelman

May 20, 2023 12:01 am ET

In the end, those 4 years a student is in school (6-7 if you play lacrosse) , are really a place for businesses to weed out wasting an investment in someone younger out of HS to mentor and apprentice them via OJT via immersion. And, if they go straight into the workforce, while they are working, they can take those micro certifications, like Microsoft database certs, or environmental certs, etc.

As an aside, I get young adults straight out college with ME/EE degrees from UMD, York, VT, ND and others, and also hire from the military. To be frank, the military hires always outperform the college grads. Then, as they navigate up the ladder, they are then 'forced/required' to hold an undergrad degree at a minimum, forcing them to enroll and check that box just to get to another level; which I believe the latter is to your point...the ROI. All I am saying, is if the businesses no longer required a degree (with the exception of some STEM), we would have far more people available to support challenging careers. Additionally, those that did not attain and undergrad or higher, seem to also become the overachievers...as witnessed by the ex-military we witness.

A fraudulent intent, however carefully concealed at the outset, will generally, in the end, betray itself.

~Livy

“There are two ways to be fooled. One is to believe what isn’t true; the other is to refuse to believe what is true.” -Soren Kierkegaard

~Livy

“There are two ways to be fooled. One is to believe what isn’t true; the other is to refuse to believe what is true.” -Soren Kierkegaard

-

Typical Lax Dad

- Posts: 34084

- Joined: Mon Jul 30, 2018 12:10 pm

Re: The Nation's Financial Condition

I plan on it. Guys would be better off at work.youthathletics wrote: ↑Sat May 20, 2023 11:48 amTypical Lax Dad wrote: ↑Sat May 20, 2023 11:45 amso most people that don’t go to college end up as overachievers?youthathletics wrote: ↑Sat May 20, 2023 11:35 am....still missing my point. My comment has nothing to do with the student, his ROI, or whether they are college material or not. It Is about business institutions, which we are hearing more and more about, bypassing the prerequisite to have a 4 year degree. An 18 y/o wanting to be a firefighter, a banker, an accountant.....can very well learn all they need while immersed in their craft, just as you and I each day with young minds.Typical Lax Dad wrote: ↑Sat May 20, 2023 9:57 amThe point is you ain’t said nothing new. College isn’t for everyone but you better have something beyond a HS diploma. Data has shown that going to college pays. The ROI far exceeds equity market returns......youthathletics wrote: ↑Sat May 20, 2023 9:20 am...you missed the entire point.Typical Lax Dad wrote: ↑Sat May 20, 2023 9:01 amYou can advise the kids that you know to not go to college….I will advise the kids that I know to go to college.youthathletics wrote: ↑Sat May 20, 2023 8:50 amCan it be summed up as the dog chasing its tail with the exception of some STEM schools/programs?Farfromgeneva wrote: ↑Sat May 20, 2023 7:53 am College graduates continue to command higher wages, but to combat falling enrollment, schools need to emphasize skills over credentials

By Jeffrey Selingo and Matt Sigelman

May 20, 2023 12:01 am ET

In the end, those 4 years a student is in school (6-7 if you play lacrosse) , are really a place for businesses to weed out wasting an investment in someone younger out of HS to mentor and apprentice them via OJT via immersion. And, if they go straight into the workforce, while they are working, they can take those micro certifications, like Microsoft database certs, or environmental certs, etc.

As an aside, I get young adults straight out college with ME/EE degrees from UMD, York, VT, ND and others, and also hire from the military. To be frank, the military hires always outperform the college grads. Then, as they navigate up the ladder, they are then 'forced/required' to hold an undergrad degree at a minimum, forcing them to enroll and check that box just to get to another level; which I believe the latter is to your point...the ROI. All I am saying, is if the businesses no longer required a degree (with the exception of some STEM), we would have far more people available to support challenging careers. Additionally, those that did not attain and undergrad or higher, seem to also become the overachievers...as witnessed by the ex-military we witness.Enjoy the games.

“I wish you would!”

-

Farfromgeneva

- Posts: 23818

- Joined: Sat Feb 23, 2019 10:53 am

Re: The Nation's Financial Condition

Basketball player transferring fromyouthathletics wrote: ↑Sat May 20, 2023 8:50 amCan it be summed up as the dog chasing its tail with the exception of some STEM schools/programs?Farfromgeneva wrote: ↑Sat May 20, 2023 7:53 am College graduates continue to command higher wages, but to combat falling enrollment, schools need to emphasize skills over credentials

By Jeffrey Selingo and Matt Sigelman

May 20, 2023 12:01 am ET

In the end, those 4 years a student is in school (6-7 if you play lacrosse) , are really a place for businesses to weed out wasting an investment in someone younger out of HS to mentor and apprentice them via OJT via immersion. And, if they go straight into the workforce, while they are working, they can take those micro certifications, like Microsoft database certs, or environmental certs, etc.

Harvard to OSU to Howard is on year 8

Now I love those cowboys, I love their gold

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

-

Farfromgeneva

- Posts: 23818

- Joined: Sat Feb 23, 2019 10:53 am

Re: The Nation's Financial Condition

Making it through four years at that age is still an accomplishment with real signaling value. To deny that ignores the labor market. It’s blemished and I’d tear a lot of the system up and rework it but it’s value still is there. The perception decline is something academics and ivory towers types ignore at their peril however. It’s not very smart to believe perception doesn’t matter.Typical Lax Dad wrote: ↑Sat May 20, 2023 9:01 amYou can advise the kids that you know to not go to college….I will advise the kids that I know to go to college.youthathletics wrote: ↑Sat May 20, 2023 8:50 amCan it be summed up as the dog chasing its tail with the exception of some STEM schools/programs?Farfromgeneva wrote: ↑Sat May 20, 2023 7:53 am College graduates continue to command higher wages, but to combat falling enrollment, schools need to emphasize skills over credentials

By Jeffrey Selingo and Matt Sigelman

May 20, 2023 12:01 am ET

In the end, those 4 years a student is in school (6-7 if you play lacrosse) , are really a place for businesses to weed out wasting an investment in someone younger out of HS to mentor and apprentice them via OJT via immersion. And, if they go straight into the workforce, while they are working, they can take those micro certifications, like Microsoft database certs, or environmental certs, etc.

Now I love those cowboys, I love their gold

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

-

Farfromgeneva

- Posts: 23818

- Joined: Sat Feb 23, 2019 10:53 am

Re: The Nation's Financial Condition

I’m a big believer in specialization (combined with broad based practical knowledge not in isolation) but my biggest problem with the structure of higher ed today is iatrogenics (caused by the healer) which by definition is focused on medicine but applied by Taleb and others to all forms of specialized knowledge.OCanada wrote: ↑Sat May 20, 2023 9:11 amShould we forego the idea off a graduate degree for medicine or law or science or …..Typical Lax Dad wrote: ↑Sat May 20, 2023 9:01 amYou can advise the kids that you know to not go to college….I will advise the kids that I know to go to college.youthathletics wrote: ↑Sat May 20, 2023 8:50 amCan it be summed up as the dog chasing its tail with the exception of some STEM schools/programs?Farfromgeneva wrote: ↑Sat May 20, 2023 7:53 am College graduates continue to command higher wages, but to combat falling enrollment, schools need to emphasize skills over credentials

By Jeffrey Selingo and Matt Sigelman

May 20, 2023 12:01 am ET

In the end, those 4 years a student is in school (6-7 if you play lacrosse) , are really a place for businesses to weed out wasting an investment in someone younger out of HS to mentor and apprentice them via OJT via immersion. And, if they go straight into the workforce, while they are working, they can take those micro certifications, like Microsoft database certs, or environmental certs, etc.

Base definition:

https://en.m.wikipedia.org/wiki/Iatrogenesis

How it’s been adopted more broadly as specialization has increased:

https://fs.blog/iatrogenics/

There’s a bunch of nuts who don’t understand this when they call for coaches heads in this sport we all love-see the MD, Hop and UNC threads. Rutgers for a few as well.

Now I love those cowboys, I love their gold

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

-

Farfromgeneva

- Posts: 23818

- Joined: Sat Feb 23, 2019 10:53 am

Re: The Nation's Financial Condition

Corporate jobs don’t pay as much when I left my last gig I got a job offer to be assistant treasurer at UPS a Fortune 500 company and the base was $105 with some modest stock and incentive target of 20-50%. Granted the work day is done after lunch mostly vs travel, weekends and long evenings later in life but you also have to wit forever to get the next step or look outside the company at that point. Basically the treasurer or CFO has to leave or f up so bad they get tossed.Typical Lax Dad wrote: ↑Sat May 20, 2023 9:57 amThe point is you ain’t said nothing new. College isn’t for everyone but you better have something beyond a HS diploma. Data has shown that going to college pays. The ROI far exceeds equity market returns. I have mentioned a couple of times kids that I have advised kids to pursue a trade first. One kid was a HVAC technician before going to PWC…..guess which career offers him more upside? Again, college isn’t for everyone. Friends son played NEC lacrosse…worked for a financial service company out of college and didn’t like it….became a firefighter….nowyouthathletics wrote: ↑Sat May 20, 2023 9:20 am...you missed the entire point.Typical Lax Dad wrote: ↑Sat May 20, 2023 9:01 amYou can advise the kids that you know to not go to college….I will advise the kids that I know to go to college.youthathletics wrote: ↑Sat May 20, 2023 8:50 amCan it be summed up as the dog chasing its tail with the exception of some STEM schools/programs?Farfromgeneva wrote: ↑Sat May 20, 2023 7:53 am College graduates continue to command higher wages, but to combat falling enrollment, schools need to emphasize skills over credentials

By Jeffrey Selingo and Matt Sigelman

May 20, 2023 12:01 am ET

In the end, those 4 years a student is in school (6-7 if you play lacrosse) , are really a place for businesses to weed out wasting an investment in someone younger out of HS to mentor and apprentice them via OJT via immersion. And, if they go straight into the workforce, while they are working, they can take those micro certifications, like Microsoft database certs, or environmental certs, etc.

Trying to get back into financial services…..Michigan recruiting him for lax but dad didn’t want him to go because he wouldn’t be able to get to as many games. An electrician and his weekend schedule isn’t flexible. I tried to convince him to send his kid to Michigan….I trained his kid growing up and coached him in hoops. Excellent defender, BTW.

Now I love those cowboys, I love their gold

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah