https://twitter.com/hoarsewisperer/stat ... 30784?s=21

Epic NY rant.

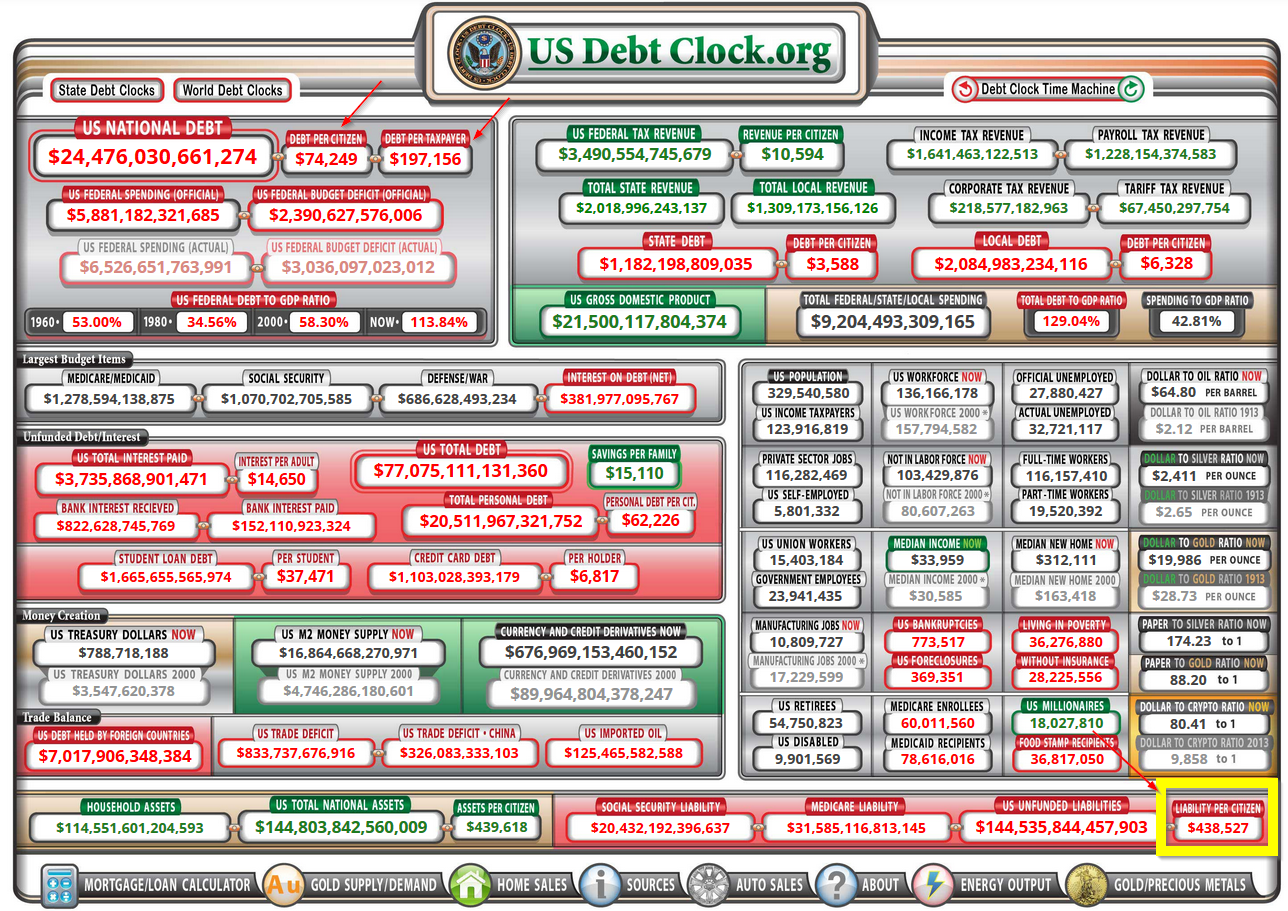

The Nation's Financial Condition

Re: The Nation's Financial Condition

“I don’t take responsibility at all.” —Donald J Trump

Re: The Nation's Financial Condition

See? Now if a guy like me, and a guy like him can figure out where the money needs to go FIRST with no trouble whatsoever.....

......how is it you can't get half of the Senate to figure it out?

Answer: they're all millionaires, and don't understand what bills mean when you're on a budget.

......how is it you can't get half of the Senate to figure it out?

Answer: they're all millionaires, and don't understand what bills mean when you're on a budget.

Re: The Nation's Financial Condition

Where you been that was posted on here days ago.Trinity wrote: ↑Wed Apr 22, 2020 11:55 am https://twitter.com/hoarsewisperer/stat ... 30784?s=21

Epic NY rant.

Re: The Nation's Financial Condition

One TRILLION dollars were added to the national debt in just the last five weeks...

by cradleandshoot » Fri Aug 13, 2021 8:57 am

Mr moderator, deactivate my account.

You have heck this forum up to making it nothing more than a joke. I hope you are happy.

This is cradle and shoot signing out.

Mr moderator, deactivate my account.

You have heck this forum up to making it nothing more than a joke. I hope you are happy.

This is cradle and shoot signing out.

-

Farfromgeneva

- Posts: 23215

- Joined: Sat Feb 23, 2019 10:53 am

Re: The Nation's Financial Condition

If the demand will always exceed the supply it still makes its non story. I’d add that these businesses still have to maintain their payroll in exchange for loan, ie imagine a server at Ruth Chris has an easier time earning a living than a lot of small restaurants. The guy concerned about moral hazard and if this doesn’t bother me it should say something. Very franchisee uses SBA pretty much, I dont distinguish much between a individual location of a larger concept and “local” independent when the goal was payroll protection and comes with payroll certification responsibilities. There’s too much to do about buying local in this country, a rich world problem. And a guy like Kevin Rathbun or Tom Colicchio would fall into the small business category but less of merit than some larger businesses, so distinguishing when we’re literally talking about 1/10th or 1% doesn’t make any sense to me. I feel like your too focused on the restaurant industry which is land of failure anyways.a fan wrote: ↑Wed Apr 22, 2020 11:22 amIf all the small businesses that applied received funds? I'd agree.Farfromgeneva wrote: ↑Wed Apr 22, 2020 7:53 am So approx 1/10th of 1% of the program. That doesn’t even seem worthy of writing a response story about.

That's not what happened.

And this "reloading" won't last a week. Congress is in la-la land.

Now I love those cowboys, I love their gold

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

-

Farfromgeneva

- Posts: 23215

- Joined: Sat Feb 23, 2019 10:53 am

Re: The Nation's Financial Condition

And many already struggling and near failure businesses are being bailed out by this program too, likely greater than that $365mm. I’m looking at a couple of loan books in N.C., S FL and Va right now and confirm that for a fact. Saves the borrowers bacon and the bank as well (for now).jhu72 wrote: ↑Wed Apr 22, 2020 11:38 amYup, a lot of truly small businesses could have been saved with 3/8 of a billion dollars.a fan wrote: ↑Wed Apr 22, 2020 11:22 amIf all the small businesses that applied received funds? I'd agree.Farfromgeneva wrote: ↑Wed Apr 22, 2020 7:53 am So approx 1/10th of 1% of the program. That doesn’t even seem worthy of writing a response story about.

That's not what happened.

And this "reloading" won't last a week. Congress is in la-la land.

This seriously isn’t a story. In a $350 BILLION program if the number doesn’t start with a $ B it’s a non event. Slippage is worse than that.

Now I love those cowboys, I love their gold

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

-

Farfromgeneva

- Posts: 23215

- Joined: Sat Feb 23, 2019 10:53 am

Re: The Nation's Financial Condition

How come no one cares about hotel owners getting dough but focuses on restaurants? My nephew has a full time job out of college (Linfield in OR, he played baseball there) with a 20yr old small business baseball training clinic and facility. They have a stupid accountant as “CFO” who didn’t submit as fast and didn’t get it even though I warned my Nephew to tell his boss to get in queue ASAP. (Accountants shouldn’t be CFOs if there’s any need for forecasting and planning, woefully poorly executed by small most small and mid sized businesses I’ve both seen personally and confirmed by many ABL, factoring and other non bank lending execs I know)

https://www.wsj.com/articles/dallas-hot ... 27?mod=mhp

https://www.wsj.com/articles/dallas-hot ... 27?mod=mhp

Now I love those cowboys, I love their gold

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

Re: The Nation's Financial Condition

Not remotely true. Did any of these small businesses complain about the initial bailout for big business? No.Farfromgeneva wrote: ↑Wed Apr 22, 2020 1:24 pm If the demand will always exceed the supply it still makes its non story.

This program is touted to help companies with fewer than 500 employees. CLEARLY that didn't happen, and that's why people are rightfully upset.

I'm focused on them because they're one of the largest employers in the country.Farfromgeneva wrote: ↑Wed Apr 22, 2020 1:24 pm I feel like your too focused on the restaurant industry which is land of failure anyways.

They're not even close the land of failure on the macro level. That's manufacturing.

Restaurants/Hospitality added almost 3,000,000 jobs in just the last ten years. Manufacturing? Lost 700,000.

One restaurant failing.....that is quickly replaced by two more is not the land of failure.

-

Farfromgeneva

- Posts: 23215

- Joined: Sat Feb 23, 2019 10:53 am

Re: The Nation's Financial Condition

SIC data shows the data on restaurant life cycles. Industrial businesses don’t cause the 3-6yr default rate in SBA loans but restaurants do. It’s a bit disingenuous to compare a industrial that had a decade plus run to fly by night in and out businesses IMO. One restaurant being replaced by another is just retail real estate owners churning tenants to maintain ultra high net rental rates, nothing else. And too many restaurant owners are too stupid to focus on occupancy cost and table turn time in pricing their menu.

Do you know small businesses didn’t complain? None of them? Specious are best.

I reiterate the title is payroll protection. And it’s not the banks that determined a larger business could get the money, it was the SBA and Treasury. Just because it was marketed by a bunch of liars, which you’ve already stated you think (like I do) of this administration and Congress, doesn’t mean you should believe it. Same as complaining about the POTUS. He’s done exactly what the dude should be expected to do given his life history.

You sure you’re focused on restaurants primarily because they are a large employer? Or being a distillery selling into the industry maybe has an outsized influence on your focused there? Again they don’t provide a living for most just because you know a couple of sommoliers who opened restaurants and have done well. By that virtue I’m friends with this dude Luca who was a cook at a good pizza joint in Atlanta called Anticco and opened his own spot for $2mm in capital and now has a couple of locations known as Varun Napoli. None of his employees earn a long term living working there, only he and his investors do well. (He deserves it, worked his ass of for years and had this dream but his people aren’t killing it).

Do you know small businesses didn’t complain? None of them? Specious are best.

I reiterate the title is payroll protection. And it’s not the banks that determined a larger business could get the money, it was the SBA and Treasury. Just because it was marketed by a bunch of liars, which you’ve already stated you think (like I do) of this administration and Congress, doesn’t mean you should believe it. Same as complaining about the POTUS. He’s done exactly what the dude should be expected to do given his life history.

You sure you’re focused on restaurants primarily because they are a large employer? Or being a distillery selling into the industry maybe has an outsized influence on your focused there? Again they don’t provide a living for most just because you know a couple of sommoliers who opened restaurants and have done well. By that virtue I’m friends with this dude Luca who was a cook at a good pizza joint in Atlanta called Anticco and opened his own spot for $2mm in capital and now has a couple of locations known as Varun Napoli. None of his employees earn a long term living working there, only he and his investors do well. (He deserves it, worked his ass of for years and had this dream but his people aren’t killing it).

Now I love those cowboys, I love their gold

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

Re: The Nation's Financial Condition

No argument here. Most restaurant owners can't tell you what their food costs are. No joke.Farfromgeneva wrote: ↑Wed Apr 22, 2020 2:30 pm SIC data shows the data on restaurant life cycles. Industrial businesses don’t cause the 3-6yr default rate in SBA loans but restaurants do. It’s a bit disingenuous to compare a industrial that had a decade plus run to fly by night in and out businesses IMO. One restaurant being replaced by another is just retail real estate owners churning tenants to maintain ultra high net rental rates, nothing else. And too many restaurant owners are too stupid to focus on occupancy cost and table turn time in pricing their menu.

That said, the number of employees (hospitality and restaurants) grew by 3,000,000. Thats not possible in a failing industry. That's all I'm saying.

No. I'm also focused on them because they are structuring differently than every other business sector....they have no assets, don't own the building they are in, and the bulk of employees work for tips.Farfromgeneva wrote: ↑Wed Apr 22, 2020 2:30 pm You sure you’re focused on restaurants primarily because they are a large employer? Or being a distillery selling into the industry maybe has an outsized influence on your focused there?

That, and I'm thinking about "what's next".

Pretend what most of us in the industry think will happen, does happen....and 30%-50% of indie shops will fail. I hope those numbers are wrong, but if it's anywhere close....picture what that would do to American real estate. And who is going to go into those spaces in the middle of a recession?

I'm trying to figure out how to keep that from happening. I already gave my ideas...what they are doing now won't work.

All they had to do is cut checks for $5 per person per month...and hand out mortgage holidays. That's it. If they did that? We wouldn't be having all these problems, and the cost of this bailout would be less than what they are doing now.

Last edited by a fan on Wed Apr 22, 2020 4:08 pm, edited 1 time in total.

-

Farfromgeneva

- Posts: 23215

- Joined: Sat Feb 23, 2019 10:53 am

Re: The Nation's Financial Condition

Well that has a ton to do with the general lack of barriers to entry and SBA loans in the first place. Can’t get an SBA loan for a startup manufacturing plant usually due to capital needs alone.

And having spent time in a CMBS unit and for a CRE CDO platform I could really care less about CRE, which has been largely institutionalized in the last 20yrs. Most mom and pop CRE owners are in failing smaller communities (like a Binghamton) where storefronts have already been boarded up for a decade plus and main streets look like Beirut on a good day.

I’m fine with the direct payments to individuals, whether $5k is the right number I don’t know but the rest is theatre.

And having spent time in a CMBS unit and for a CRE CDO platform I could really care less about CRE, which has been largely institutionalized in the last 20yrs. Most mom and pop CRE owners are in failing smaller communities (like a Binghamton) where storefronts have already been boarded up for a decade plus and main streets look like Beirut on a good day.

I’m fine with the direct payments to individuals, whether $5k is the right number I don’t know but the rest is theatre.

Now I love those cowboys, I love their gold

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

- MDlaxfan76

- Posts: 26274

- Joined: Wed Aug 01, 2018 5:40 pm

Re: The Nation's Financial Condition

Is this the road we're on? It sure feels like it.

Do you think the current crisis will change the way investors behave?

I hope so. We should actually know that life is a risk. As a society, as a company and as an investor, you have to be prepared for crises and setbacks. It is clear that our healthcare system was not prepared for such a crisis. And only now do we realize that 70% of the basic elements for the pharmaceutical industry come from China. This is insane. I am a supporter of free trade, but today’s crisis shows the fragility of our wide-ranging supply chains. What also concerns me is the short-term thinking of managers who have inflated their companies with debt to finance share buybacks. It is simply negligent. These managers should be fired. There is a lack of personal responsibility everywhere, not just among managers. Our entire society has forgotten how to take responsibility. We have forgotten that life consists of setbacks and that you have to have safety margins for difficult times. We live in a spoiled society where people think they are entitled to a wonderful life. Well, this right does not exist in reality. And the constant cry for help to central banks and governments whenever it rains will gradually cost us freedom and prosperity.

Felix W. Zulauf is founder and owner of Zulauf Asset Management, based in Baar, Switzerland, offering investment advice for clients worldwide. He has spent almost fifty years in the professional investment business. He served as a member of the famed Barron’s Roundtable for thirty years.

https://themarket.ch/interview/felix-zu ... ns-ld.1841

Do you think the current crisis will change the way investors behave?

I hope so. We should actually know that life is a risk. As a society, as a company and as an investor, you have to be prepared for crises and setbacks. It is clear that our healthcare system was not prepared for such a crisis. And only now do we realize that 70% of the basic elements for the pharmaceutical industry come from China. This is insane. I am a supporter of free trade, but today’s crisis shows the fragility of our wide-ranging supply chains. What also concerns me is the short-term thinking of managers who have inflated their companies with debt to finance share buybacks. It is simply negligent. These managers should be fired. There is a lack of personal responsibility everywhere, not just among managers. Our entire society has forgotten how to take responsibility. We have forgotten that life consists of setbacks and that you have to have safety margins for difficult times. We live in a spoiled society where people think they are entitled to a wonderful life. Well, this right does not exist in reality. And the constant cry for help to central banks and governments whenever it rains will gradually cost us freedom and prosperity.

Felix W. Zulauf is founder and owner of Zulauf Asset Management, based in Baar, Switzerland, offering investment advice for clients worldwide. He has spent almost fifty years in the professional investment business. He served as a member of the famed Barron’s Roundtable for thirty years.

https://themarket.ch/interview/felix-zu ... ns-ld.1841

If we need that extra push over the cliff, ya know what we do...eleven, exactly.

-

Farfromgeneva

- Posts: 23215

- Joined: Sat Feb 23, 2019 10:53 am

Re: The Nation's Financial Condition

Gotta read a book called Antifragile by Nassim Nicholas Taleb if you like that note above quoted.

All personal agency went out the window a while back

It would seem..

All personal agency went out the window a while back

It would seem..

Now I love those cowboys, I love their gold

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

Love my uncle, God rest his soul

Taught me good, Lord, taught me all I know

Taught me so well, that I grabbed that gold

I left his dead ass there by the side of the road, yeah

-

seacoaster

- Posts: 8866

- Joined: Thu Aug 02, 2018 4:36 pm

Re: The Nation's Financial Condition

Thanks for posting this. Very interesting.Nigel wrote: ↑Thu Apr 23, 2020 12:27 am Is this the road we're on? It sure feels like it.

Do you think the current crisis will change the way investors behave?

I hope so. We should actually know that life is a risk. As a society, as a company and as an investor, you have to be prepared for crises and setbacks. It is clear that our healthcare system was not prepared for such a crisis. And only now do we realize that 70% of the basic elements for the pharmaceutical industry come from China. This is insane. I am a supporter of free trade, but today’s crisis shows the fragility of our wide-ranging supply chains. What also concerns me is the short-term thinking of managers who have inflated their companies with debt to finance share buybacks. It is simply negligent. These managers should be fired. There is a lack of personal responsibility everywhere, not just among managers. Our entire society has forgotten how to take responsibility. We have forgotten that life consists of setbacks and that you have to have safety margins for difficult times. We live in a spoiled society where people think they are entitled to a wonderful life. Well, this right does not exist in reality. And the constant cry for help to central banks and governments whenever it rains will gradually cost us freedom and prosperity.

Felix W. Zulauf is founder and owner of Zulauf Asset Management, based in Baar, Switzerland, offering investment advice for clients worldwide. He has spent almost fifty years in the professional investment business. He served as a member of the famed Barron’s Roundtable for thirty years.

https://themarket.ch/interview/felix-zu ... ns-ld.1841

- Jim Malone

- Posts: 298

- Joined: Thu Nov 15, 2018 1:27 pm

- Location: Long Island, New York

Re: The Nation's Financial Condition

McConnell Says He Favors Letting States Declare Bankruptcy

https://www.bloomberg.com/news/articles ... bankruptcy

Rejecting executors contracts will be a real pip. State pension agreements first up, guaranteed.

https://www.bloomberg.com/news/articles ... bankruptcy

Rejecting executors contracts will be a real pip. State pension agreements first up, guaranteed.

The parent, not the coach.

-

seacoaster

- Posts: 8866

- Joined: Thu Aug 02, 2018 4:36 pm

Re: The Nation's Financial Condition

And at least Rubin thinks it's a bad idea (see below). Jim M., what do you think (as a bankruptcy and workout specialist)?Jim Malone wrote: ↑Thu Apr 23, 2020 9:18 am McConnell Says He Favors Letting States Declare Bankruptcy

https://www.bloomberg.com/news/articles ... bankruptcy

Rejecting executors contracts will be a real pip. State pension agreements first up, guaranteed.

https://www.washingtonpost.com/opinions ... aybe-ever/

"Senate Majority Leader Mitch McConnell (R-Ky.) was dead-set against giving unrestricted funds to states and local governments in the covid-19 relief bill the Senate passed Tuesday. Instead, he wants states to be able to declare bankruptcy, which would mean pension plans, government contractors, union workers and a whole slew of other stakeholders would suffer. He blithely declares, after spending trillions of dollars on everything from airline bailouts to small-business loans to enhanced employment that we shouldn’t borrow to fund state and local governments. He might want to check back with the folks in Kentucky.

McConnell’s position is not only hypocritical but unsound and politically dumb. State and local governments employ millions of people around the country. If McConnell wants to reopen the economy and stem unemployment, the last thing he should do would be to let states and cities founder and institute painful cuts.

Full coverage of the coronavirus pandemic

Many Republicans find his position daft. That may include President Trump, who purportedly told New York Gov. Andrew M. Cuomo (D) on Tuesday that he would support state and local funding in the next big funding bill. Republican Sen. Rob Portman (Ohio), whose home-state governor is also a Republican, objected:

Rob Portman

✔

@senrobportman

The skyrocketing unemployment rate and subsequent decline in tax revenue has left local gov’ts stretched to the limit.

As I told Ohio's county commissioners on our call this morning, I'm working w/ my colleagues to secure additional and more flexible funding.

2:04 PM - Apr 22, 2020

As a political matter, the move is hugely damaging to Republicans — and House Speaker Nancy Pelosi (D-Calif.) knows it. You will notice that she no longer talks about state funding; she talks about money for our “heroes.” During an MSNBC interview on Wednesday, she explained that state and local funding means funding for “the health-care worker, the police and fire, the first responders, the emergency services people, the teachers in our schools, the transportation workers." She added, “Again, it is about the people. And these people are risking their lives to help save other lives and now they are losing their jobs.” She will be calling it the “Heroes Act.”

Pelosi confirmed that Trump seems to favor such spending as well. (”The President himself has even said, he has tweeted out . . . that he is ready to do state and local [funding], that he knows there has to be another bill and there are other measures that need to be addressed in that legislation. It is going to be a major package." Treasury Secretary Steven Mnuchin has also said the federal government will spend “whatever it takes” to recover from the coronavirus-induced recession.

McConnell’s position, therefore, makes no practical or political sense. It’s the Herbert Hoover mentality all over again, as though fiscal tightening is the antidote to recession. It nevertheless is revealing of the ongoing contempt many Republicans (including many in the donor class) have for good governance and active, nimble government. The position is entirely out of step with popular opinion that wants government action now. Americans who are still employed are fearful of losing their jobs and, moreover, are deeply sympathetic toward lifesaving first responders and other local government workers right now.

McConnell, as he did in the bill the Senate passed Tuesday, has gotten into the habit of drawing lines in the sand (Only $250 billion for small business — nothing else!) only to be outmaneuvered by the House and the administration. He looks increasingly feckless and out of step even with his own party. Kentucky voters have an opportunity in November to make a change and elect someone who might actually fight for their state rather than suggesting bankruptcy, further layoffs and a kick in the shins to first responders. They should take it."

-

Peter Brown

- Posts: 12878

- Joined: Fri Mar 15, 2019 11:19 am

Re: The Nation's Financial Condition

Jim Malone wrote: ↑Thu Apr 23, 2020 9:18 am McConnell Says He Favors Letting States Declare Bankruptcy

https://www.bloomberg.com/news/articles ... bankruptcy

Rejecting executors contracts will be a real pip. State pension agreements first up, guaranteed.

Bankruptcy of states and counties most happen, regardless which party controls the Congress.

The nature of some states' pension schemes is incredible, certainly unsustainable, and often leads to density restriction zoning codes being broken apart (*which leads to socially intimate community diseases...?) because politico's need that dosh hence more density. It's amazing even more people don't simply pack up and move to red states.

Check out these teacher pension thefts in Nassau County LI.

https://nypost.com/2020/02/02/some-long ... over-300k/

Cops not far behind!

https://www.empirecenter.org/publicatio ... ping-100k/

These blue states earned every dollar of economic disaster headed their way.

-

Peter Brown

- Posts: 12878

- Joined: Fri Mar 15, 2019 11:19 am

Re: The Nation's Financial Condition

Mitch is doing a favor to these Dem politicians. They get to blame Mitch for declaring bankruptcy.

Covid has sped up these state's eventual disastrous ends. Take advantage and go ahead and declare bankruptcy. Then blame Mitch. Who has it better than that? You do all the reckless stuff then get to blame some guy in Kentucky.

If any of these reckless blue states declare bankruptcy and reset these obscene pension schemes, people like me might actually buy property up there again.

https://www.msn.com/en-us/news/politics ... r-BB1336bq

Covid has sped up these state's eventual disastrous ends. Take advantage and go ahead and declare bankruptcy. Then blame Mitch. Who has it better than that? You do all the reckless stuff then get to blame some guy in Kentucky.

If any of these reckless blue states declare bankruptcy and reset these obscene pension schemes, people like me might actually buy property up there again.

https://www.msn.com/en-us/news/politics ... r-BB1336bq

Re: The Nation's Financial Condition

Peter Brown wrote: ↑Thu Apr 23, 2020 9:44 am Check out these teacher pension thefts in Nassau County LI.

https://nypost.com/2020/02/02/some-long ... over-300k/

Cops not far behind!

https://www.empirecenter.org/publicatio ... ping-100k/

These blue states earned every dollar of economic disaster headed their way.

How many restaurants and tourist spots do you have in Florida, again?

Now how big of a tax shortfall do you think Florida and its many cities and counties will have because no one is vacationing in your State? And how long do you think this shortfall will last? Layoffs. Furloughs.

You and Mitchey don't understand what's happening.